Japan Crypto Licensing Framework for Exchanges: What You Need to Know in 2026

Japan doesn’t just regulate crypto exchanges - it redefines what a licensed exchange must be. If you’re thinking about operating or using a crypto platform in Japan, you’re not dealing with a simple checklist. You’re stepping into one of the strictest, most detailed regulatory systems in the world - and it changed dramatically in September 2025.

Why Japan’s Crypto Rules Are Different

Most countries treat crypto like a wild frontier. Japan treats it like a bank. Since 2017, virtual currencies have been legally recognized as property under the Payment Services Act (PSA). But that wasn’t enough. After the Coincheck hack in 2018 - where $534 million in NEM tokens vanished - Japan realized it needed more than just rules. It needed armor. In September 2025, the Financial Services Agency (FSA) moved crypto oversight from the PSA to the Financial Instruments and Exchange Act (FIEA). This wasn’t a tweak. It was a full upgrade. Now, crypto assets aren’t just payment tools - they’re financial instruments. That means exchanges handling tokens with investment features (like staking rewards or profit-sharing mechanisms) now fall under the same rules as stock brokers. This shift eliminated the messy gray area that confused regulators in the U.S. and Europe.Who Can Even Apply for a License?

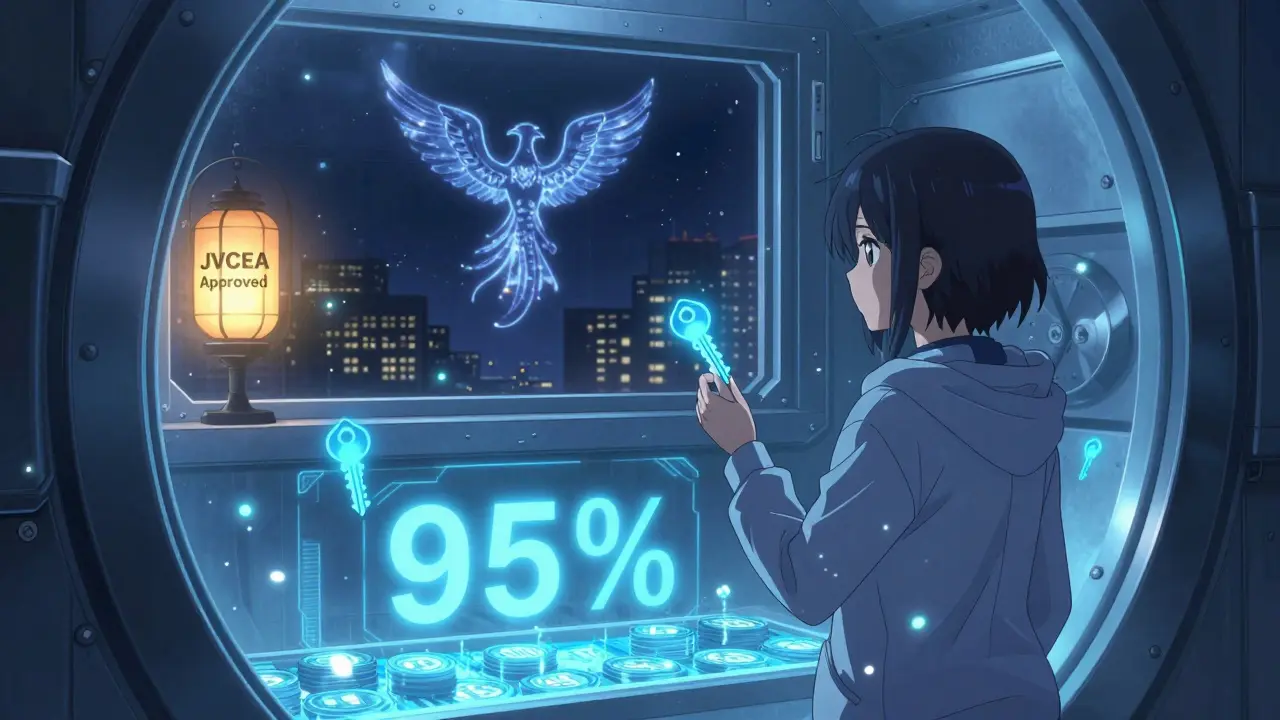

You can’t just register online and start trading. To even begin the process, you must be a kabushiki-kaisha - a Japanese joint-stock company. That means you need a physical office in Japan, a local manager who can be held personally liable, and a clean corporate record. No offshore shell companies. No anonymous founders. No exceptions. The capital requirement is brutal: at least 10 million yen (about $68,000 USD) in paid-in capital, plus positive net assets. Most serious applicants spend over $500,000 just to prepare. The average time to get licensed? 18 to 24 months. That’s longer than building a small software startup from scratch. And it doesn’t stop there. You need to prove you can handle 10,000+ transactions per second with zero errors. Your AML system must flag suspicious activity in real time. Your cybersecurity team must respond to a breach within 15 minutes. And your cold storage must hold at least 95% of all customer funds offline. That’s not optional. It’s mandatory. After Coincheck, the FSA made it clear: if you lose user funds because you kept too much online, you’re done.The JVCEA: Japan’s Secret Regulatory Layer

The FSA sets the floor. The Japan Virtual Currency Exchange Association (JVCEA) sets the ceiling. Eighteen of the 21 licensed exchanges are members of JVCEA - and they follow rules that are even tighter than the FSA’s. The most powerful tool? The Token Listing Committee. This 17-member panel reviews every new token before it can be listed. In Q2 2025 alone, they rejected 72% of applications. Why? Because most tokens lacked proper audits, had unclear use cases, or looked like pump-and-dump schemes. Compare that to Singapore, where exchanges can list tokens themselves. Or the U.S., where the SEC picks and chooses which tokens are securities. Japan’s system is slow, but it’s predictable. If a token gets approved by JVCEA, you know it’s been through a gauntlet. That’s why retail investors trust Japanese exchanges more than others.

What You Can’t Do - Even If You’re Licensed

Getting a license doesn’t mean you can offer everything. Japan bans high-risk products that are common elsewhere:- No leverage above 2x. That’s down from 4x in 2023. Day traders who rely on 10x or 20x leverage have left for Dubai or Singapore.

- No margin trading on meme coins. Even if Bitcoin and Ethereum are approved, tokens like Dogecoin or Shiba Inu are blocked unless they pass a 6-month observation period.

- No staking-as-a-service unless the token is pre-approved and the risk is fully disclosed to users.

The Hidden Costs: Banking, Compliance, and Talent

The biggest surprise for new entrants? Getting a bank account. Only 8% of Japanese banks will open accounts for crypto exchanges. The rest still follow 2020 guidelines that ban direct crypto holdings. Even licensed exchanges struggle to connect to fiat on-ramps. Some hire third-party payment processors. Others partner with fintech startups that specialize in bridging crypto and traditional finance. Compliance isn’t cheap. Exchanges spend 25% of their revenue on regulatory costs - nearly double what Singaporean platforms pay. You need full-time compliance officers with Japanese financial experience. Salaries? Around ¥12 million per year ($78,000 USD). You need auditors certified by Japanese firms like NCC Group. You need DDoS protection that can handle 1 Tbps attacks - because hackers know Japanese exchanges have deep pockets.

Who Benefits? Who Gets Left Behind?

Retail investors win. In the FSA’s 2025 Consumer Confidence Report, 87% of users said they felt “very” or “somewhat” secure using licensed exchanges. That’s 24 percentage points higher than in unregulated markets. Institutional investors are watching closely. The FSA is now considering letting Japan’s megabanks - like Mitsubishi UFJ - become licensed crypto operators. That could change everything. If banks start holding Bitcoin as an asset (with 30% capital buffers and stress tests for 80% price drops), institutional money will flood in. Nomura Research forecasts 18.5 million crypto users in Japan by 2027. But startups and small exchanges? They’re getting squeezed. The cost and complexity of compliance are so high that only well-funded players survive. Since 2017, 17 exchanges have had their licenses canceled. Most didn’t fail because of hacks. They failed because they couldn’t afford the paperwork, the audits, or the banking fees.The Big Shift Coming in 2026

The FSA’s full transition to the FIEA will be complete by March 2026. But the real story is the new Electronic Payment Instrument and Crypto-asset Intermediary Service Business (ECISB) framework - still under review as of January 2026. This will create a new class of licensees called CAESPs (Crypto-asset Exchange Service Providers). Under ECISB, exchanges will need to notify the FSA before launching any new service. That includes things like crypto-backed loans, derivatives, or NFT marketplaces. It’s not a ban - it’s a checkpoint. The goal? Prevent another Terra/LUNA collapse from happening on Japanese soil. The FSA is also testing a regulatory sandbox. So far, 27 projects have been accelerated - including SBI Ripple Asia’s cross-border payment system. This shows Japan isn’t just about control. It’s about guiding innovation safely.Final Reality Check

Japan’s crypto licensing framework isn’t designed to make trading easy. It’s designed to make it safe. If you want to list a new token, you’ll wait months. If you want to offer leverage, you’ll be capped at 2x. If you want to open a bank account, you’ll hit walls. But if you’re a user? Your funds are safer here than almost anywhere else. If you’re a business? You’ll pay more, wait longer, and jump through more hoops - but you’ll also get something rare: legal certainty. In a world where regulators flip-flop, Japan’s rules stay firm. That’s why, despite the restrictions, Japan remains the world’s third-largest crypto market - and one of the most trusted.

Similar Posts

Kevin Pivko

January 26, 2026 AT 08:38Jessica Boling

January 28, 2026 AT 03:44Andy Simms

January 28, 2026 AT 20:37Jen Allanson

January 29, 2026 AT 07:36Dave Ellender

January 30, 2026 AT 00:32David Zinger

January 30, 2026 AT 19:03Catherine Hays

February 1, 2026 AT 10:32Nathan Drake

February 1, 2026 AT 14:33Arielle Hernandez

February 3, 2026 AT 06:59Tammy Goodwin

February 4, 2026 AT 19:31Nadia Silva

February 6, 2026 AT 06:47Roshmi Chatterjee

February 8, 2026 AT 02:36Julene Soria Marqués

February 9, 2026 AT 16:52Bonnie Sands

February 10, 2026 AT 13:13MOHAN KUMAR

February 12, 2026 AT 01:12Jennifer Duke

February 13, 2026 AT 06:50Abdulahi Oluwasegun Fagbayi

February 15, 2026 AT 00:15Ashok Sharma

February 15, 2026 AT 08:15Tselane Sebatane

February 15, 2026 AT 13:43Brenda Platt

February 15, 2026 AT 15:32Chidimma Catherine

February 17, 2026 AT 09:30Darrell Cole

February 18, 2026 AT 00:10Kevin Pivko

February 18, 2026 AT 19:09Andy Simms

February 19, 2026 AT 18:03