How Bolivians Use Crypto Exchanges After the 2024 Ban Lift

Bolivia Crypto VASP Compliance Checker

Verify Licensed Crypto Providers

Check if a crypto service provider is legally licensed to operate in Bolivia under Supreme Decree 5384.

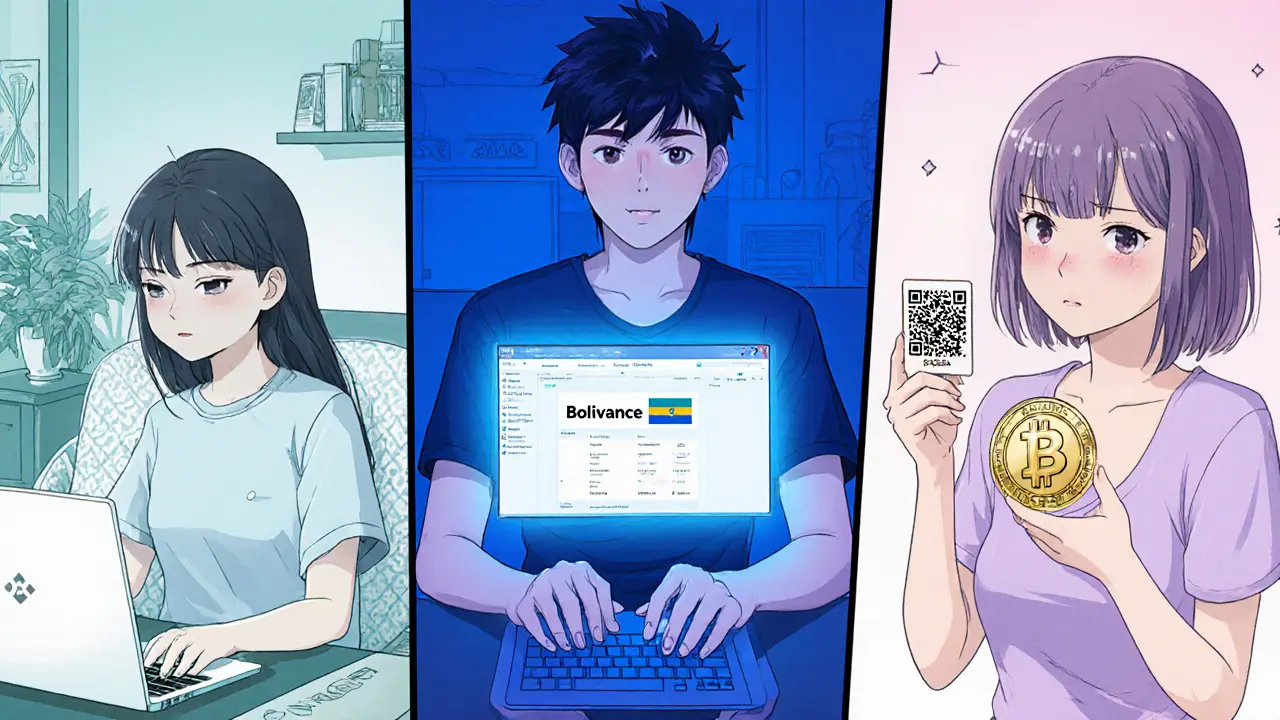

Most people still think Bolivia blocks every crypto transaction, but the reality changed dramatically in June 2024. Bolivia crypto exchange access is now legal, regulated, and growing fast. This article unpacks the new legal framework, shows the exact ways citizens trade digital assets, and clears up the myths that keep the old ban alive in headlines.

From Total Ban to Legal Framework - The Timeline

Understanding today’s landscape starts with a quick look back. The Central Bank of Bolivia (BCB) first banned all crypto activity on May 6, 2014, citing consumer protection. That restriction was reinforced several times, most notably by Resolution No. 144/2020 which reiterated the prohibition. The breakthrough arrived on June 26, 2024:

- Resolution No. 082/2024 officially lifted the ban and encouraged crypto adoption.

- In April 2025, Resolution No. 019/2025 recognized virtual assets and VASPs.

- May 2025 saw Supreme Decree No. 5384 establish a full licensing regime for crypto service providers.

Since then, crypto usage has surged over 500% and the BCB even uses USD‑pegged stablecoins for cross‑border payments.

| Aspect | 2014‑2023 (Ban Period) | 2024‑2025 (Post‑Ban) |

|---|---|---|

| Legal status of crypto | Fully prohibited | Legal with licensing |

| Bank involvement | Prohibited from handling crypto | BCB uses stablecoins for payments |

| VASPs | No licensing, illegal | Licensed under Sup. Decree5384 |

| Consumer protection | None (ban aimed at protection) | KYC/AML standards enforced |

| International access | VPNs, peer‑to‑peer only | Direct access to compliant exchanges |

How Bolivians Access Crypto Exchanges Today

With the legal obstacles removed, there are three primary routes to trade digital assets:

- Licensed Domestic VASPs: Companies that have secured a license under Supreme Decree5384 can offer spot trading, custodial wallets, and fiat on‑ramps. Examples include BolivaCoin and AndesX. These platforms verify users through the national ID system, report suspicious activity to the BCB, and charge modest fees (usually 0.25‑0.5%).

- International Exchanges with Local Partnerships: Global players like Binance and Kraken have partnered with Bolivian VASPs to provide a "local gateway". Users create an account on the international exchange, then link it to a domestic gateway that handles KYC in Bolivia. This model lets traders enjoy deep liquidity while staying compliant.

- Stablecoin‑Based Payments: The BCB has approved several USD‑pegged stablecoins (e.g., USDT, USDC) for cross‑border remittances. Many Bolivians first acquire stablecoins via certified VASPs and then move them onto global exchanges for broader crypto exposure.

All three routes share a common requirement: a verified bank account or a licensed e‑wallet, which the BCB now treats as a "crypto‑ready" financial service.

Popular VASPs and Exchanges Operating in Bolivia

Below is a snapshot of the most active service providers as of October2025. Each is fully licensed under the current framework and offers a user‑friendly mobile app.

- BolivaCoin: First Bolivian‑born exchange, focuses on BTC, ETH, and local stablecoins. Offers a 0‑fee tier for transactions under 0.001BTC.

- AndesX: Known for its P2P marketplace that matches buyers and sellers for fiat‑to‑crypto trades. Holds a VASP license since March2025.

- CryptoLa Paz: Regional hub that provides crypto‑deposits for small businesses, especially in the Yungas agricultural sector.

- Binance (Bolivia Gateway): Global exchange access via a local partner, allowing higher‑volume trades and futures (subject to additional licensing).

Workarounds Used During the Ban (What Changed)

Before June2024, crypto‑savvy Bolivians resorted to a handful of indirect methods:

- VPNs and Proxy Services: Masked IP addresses to access foreign exchanges like Coinbase or Kraken.

- P2P Platforms: Websites such as LocalBitcoins allowed cash‑in/cash‑out via meet‑ups, but these were high‑risk and often unregulated.

- Crypto ATMs: Limited to border towns; they accepted cash and dispensed Bitcoin, but operators operated in a legal gray area.

- Friends Abroad: Users would send fiat to relatives overseas, who purchased crypto and sent it back via wallet addresses.

All these pathways carried significant legal and security risks. The post‑ban environment replaces them with officially sanctioned channels, dramatically lowering the chance of fraud and government penalties.

Compliance Tips - Staying Safe While Trading

Even though crypto is now legal, the BCB enforces strict KYC/AML standards. Follow these best practices to avoid trouble:

- Use Only Licensed VASPs: Verify that the provider displays a licensing number from Supreme Decree5384.

- Secure Your Identity Documents: The BCB requires a scanned ID and proof of address for account verification.

- Report Large Transactions: Anything over 10,000USD equivalent must be reported automatically by the VASP.

- Enable Two‑Factor Authentication: All reputable platforms offer 2FA via SMS or authenticator apps.

- Avoid Unlicensed P2P Deals: They are no longer protected under the new regulations and can lead to confiscation.

Future Outlook - What’s Next for Bolivia’s Crypto Scene?

The momentum isn’t slowing. Two developments hint at more growth:

- MoU with ElSalvador’s CNAD: Signed in early 2025, this agreement gives Bolivia access to blockchain analytics tools, joint training for regulators, and a fast‑track for new fintech startups.

- Potential Central Bank Digital Currency (CBDC): The BCB is piloting a digital boliviano on a private blockchain, leveraging the same infrastructure used for stablecoin payments. If successful, it could coexist with private crypto assets.

Both signals suggest a government that sees digital assets as a strategic economic lever, not just a novelty.

Quick Checklist for Getting Started

- Confirm the VASP you choose holds a license under Supreme Decree5384.

- Complete KYC using a valid ID and utility bill.

- Deposit bolivianos via a linked bank or approved e‑wallet.

- Buy stablecoins first if you need a bridge to global exchanges.

- Enable 2FA and keep backup recovery phrases offline.

Frequently Asked Questions

Is cryptocurrency still illegal in Bolivia?

No. The ban was lifted on June262024 by Resolution No. 082/2024. Since then, crypto activities are legal as long as they are conducted through licensed VASPs.

Do I need a foreign exchange account to trade?

Not anymore. Local VASPs provide fiat on‑ramps, so you can fund your account directly from a Bolivian bank.

What are the biggest risks after the ban was lifted?

The main risks are using unlicensed platforms and ignoring AML reporting thresholds. Stick to licensed VASPs and follow BCB guidelines.

Can I still use VPNs to access foreign exchanges?

You can, but it offers no advantage now that local options exist. Plus, the BCB may view deliberate circumvention as non‑compliance.

How do stablecoins fit into Bolivia’s financial system?

The BCB has authorized USD‑pegged stablecoins for cross‑border payments and remittances. They are treated as a store of value, and owning them is fully legal.

Marques Validus

October 13, 2025 AT 08:35When the Central Bank finally pulled the plug on the 2014 prohibition, the regulatory scaffolding morphed into a full‑blown VASP architecture, leveraging AML‑KYC pipelines and liquidity aggregation protocols that were previously only whispered about in underground forums

the result is a hybrid ecosystem where domestic order‑books sync with global depth via the Bolivia Gateway, enabling sub‑0.001 BTC zero‑fee tiers and cross‑border stablecoin corridors that were once theoretical constructs

Mitch Graci

October 17, 2025 AT 23:42Wow, because nothing says “Bolivian sovereignty” like handing over your crypto to a foreign exchange with a little local badge!! 😂 The government’s so proud of its “homegrown” VASPs that they just slapped a Binance logo on a Bolivian domain!! 🙄

Michael Grima

October 22, 2025 AT 14:49Crypto freedom? Just another buzzword in the Bolivian playbook.

Hari Chamlagai

October 27, 2025 AT 04:55Let me break it down for anyone still clutching the old myth that Bolivia bans crypto: the 2024 resolution didn’t merely “allow” trading, it erected a licensing regime that mirrors EU MiCA standards. Every VASP now must embed the national ID verification API, file real‑time transaction reports with the BCB, and maintain a minimum capital reserve equal to 0.5 % of daily turnover. If a platform can’t meet these thresholds, it’s not a VASP-it’s an illegal broker, and the authorities will shut it down faster than you can say “unlicensed.” So when you hear someone brag about using a VPN to access a foreign exchange, understand they are sidestepping a robust compliance framework that actually protects users from fraud and money‑laundering.

Ben Johnson

October 31, 2025 AT 20:02Interesting how the stablecoin pipeline has become the default bridge for cross‑border remittances-kind of like the “nice” way to say “we still need dollars to move money,” isn’t it? Still, the fact that you can now buy USDT at a local VASP and slide it into Binance without a VPN is a welcome upgrade for anyone who’s tired of juggling multiple wallets just to stay legal.

Kevin Duffy

November 5, 2025 AT 11:09It’s great to see Bolivian traders finally getting legit tools-cheers to the new VASP wave! 🙌 Keep an eye on the fee tiers; those zero‑fee brackets under 0.001 BTC can really help newbies build confidence. 🚀

Tayla Williams

November 10, 2025 AT 02:15One must note that, despite the positive appearance of the new regulatory framework, the underlying intent appears to be more about governmental control than genuine consumer protection. The frequent amendments and ambiguous language used in Supreme Decree 5384 may lead to inconsistent enforcment across different jurisdictions within the country.

Brian Elliot

November 14, 2025 AT 17:22From a community perspective, the licensing of platforms like BolivaCoin and AndesX creates a shared space where both retail users and small businesses can interact under a common set of rules. This reduces friction and fosters trust, especially for agricultural producers in the Yungas region who now have a reliable way to receive crypto deposits.

Cynthia Chiang

November 19, 2025 AT 08:29For users who have been nervous about the old ban, the shift to a licensed environment is a huge relief. Knowing that your identity documents are stored securely and that the VASP must report large transactions means there’s an extra safety net. Just remember to keep your recovery phrase offline-no one can protect you better than yourself.

Jason Clark

November 23, 2025 AT 23:35Should you decide to use the Binance Bolivia Gateway, remember that you’ll still need to pass the local KYC step before you can access the deep liquidity pools. It’s not enough to just create an account on Binance.com; the gateway enforces the same ID verification as any domestic VASP, which, as everyone loves, adds an extra layer of paperwork.

Jim Greene

November 28, 2025 AT 14:42Staying compliant is easier than ever-just follow the licensing number and enable 2FA! 👍

Steve Cabe

December 3, 2025 AT 05:49The government’s partnership with foreign exchanges demonstrates a pragmatic approach: we can harness global liquidity while preserving national oversight. This strategy protects our monetary sovereignty and ensures Bolivian users aren’t left at the mercy of unregulated offshore platforms.

Mandy Hawks

December 7, 2025 AT 20:55One could argue that the emergence of licensed VASPs in Bolivia reflects a broader philosophical shift-from viewing crypto as a threat to embracing it as a tool for financial inclusion. This transition underscores the dynamic interplay between technology and societal values.

Scott G

December 12, 2025 AT 12:02It is essential for participants to acknowledge the regulatory responsibilities associated with operating within the newly established framework, thereby ensuring both compliance and the protection of consumer interests.

VEL MURUGAN

December 17, 2025 AT 03:09While the current compliance measures are a step forward, the real test will be how rigorously the BCB enforces AML reporting on high‑volume trades. If enforcement lapses, the whole ecosystem could become a front for illicit activity, undermining the trust that the licensing regime aims to build.

Russel Sayson

December 21, 2025 AT 18:15The 2024 deregulation was not a mere policy flip, it was a seismic tectonic shift that re‑engineered Bolivia’s entire financial DNA.

By mandating that every VASP integrate the national ID verification engine, the state has stitched together a digital identity fabric that was previously nonexistent.

This fabric now supports real‑time transaction monitoring, which means suspicious flows can be flagged within minutes rather than days.

For traders, the immediate benefit is access to deep liquidity pools through the Binance Bolivia Gateway, allowing trades that would have been impossible under the old ban.

Simultaneously, small businesses in the Yungas can receive crypto deposits without fearing that their funds will be frozen by an ambiguous legal regime.

The introduction of USD‑pegged stablecoins as approved cross‑border payment instruments further expands the horizon, effectively creating a bridge to the global crypto economy.

However, this bridge is guarded by strict KYC/AML protocols that demand scanned IDs, proof of address, and, for transactions over $10,000, automated reporting to the BCB.

Users who attempt to bypass these safeguards via VPNs or unlicensed P2P platforms are now exposing themselves to legal penalties that can include asset seizure.

The government’s partnership with El Salvador’s CNAD brings advanced blockchain analytics tools into the Bolivian regulatory toolbox, enhancing its ability to trace illicit activity.

In practice, this means that laundering attempts will be met with forensic scrutiny that rivals the capabilities of major western regulators.

For the crypto community, the message is clear: compliance is no longer optional but a prerequisite for sustainable growth.

Those who embrace the licensing framework will find themselves rewarded with lower fees, insurance coverage, and access to institutional‑grade services.

Conversely, entities that cling to the old “wild west” mindset will likely be marginalized and eventually blacklisted.

Looking ahead, the BCB’s pilot CBDC project may coexist with private crypto assets, offering a dual‑track monetary system that could set a global precedent.

If the pilot succeeds, Bolivia could become a showcase for how sovereign digital currencies and decentralized finance can operate in tandem.

Until that future materializes, the safest path for every participant is to verify the VASP’s license number, enable two‑factor authentication, and keep recovery phrases offline.

Isabelle Graf

December 26, 2025 AT 09:22Honestly, the whole “we’re finally modern” hype feels like a marketing ploy-nothing changes if people still ignore basic security. People need to wake up and act responsibly.

Millsaps Crista

December 31, 2025 AT 00:29Take the plunge, but do it the right way-verify the licensing, lock down your account, and never trade without proper risk management. That’s the only way to turn enthusiasm into real gains.

Matthew Homewood

January 4, 2026 AT 15:35One might perceive the regulatory evolution as a mirror reflecting society’s shifting attitudes toward decentralized finance, revealing deeper values about trust and autonomy.

Shane Lunan

January 9, 2026 AT 06:42Sure, new rules are cool but still a lot of red tape.

Jeff Moric

January 13, 2026 AT 21:49For those just starting out, the key is to choose a VASP that offers clear documentation and responsive customer support, which makes the onboarding process far less intimidating.

Bruce Safford

January 18, 2026 AT 12:55What most people don’t realize is that behind the veneer of compliance, there are hidden data streams feeding directly into foreign intelligence networks. The BCB’s “transparent” reporting system could be a backdoor for global banks to monitor Bolivian capital flows, turning our crypto freedom into a survellance tool.

Jordan Collins

January 23, 2026 AT 04:02Curiosity drives adoption-if you’re unsure about how stablecoins fit into your portfolio, start with a modest amount, track the transaction fees, and adjust your strategy as you gain confidence.

Andrew Mc Adam

January 27, 2026 AT 19:09When you step into the world of crypto in Bolivia, remember that every transaction is a tiny spark that can ignite a larger financial revolution-so handle it with care, keep your keys safe, and stay informed about regulatory updates, otherwise you might find yourself stuck in the dark.

shirley morales

February 1, 2026 AT 10:15Only the truly discerning will navigate this landscape without falling prey to hype.