Cloud Mining vs Home Mining: Which Is Better in 2026?

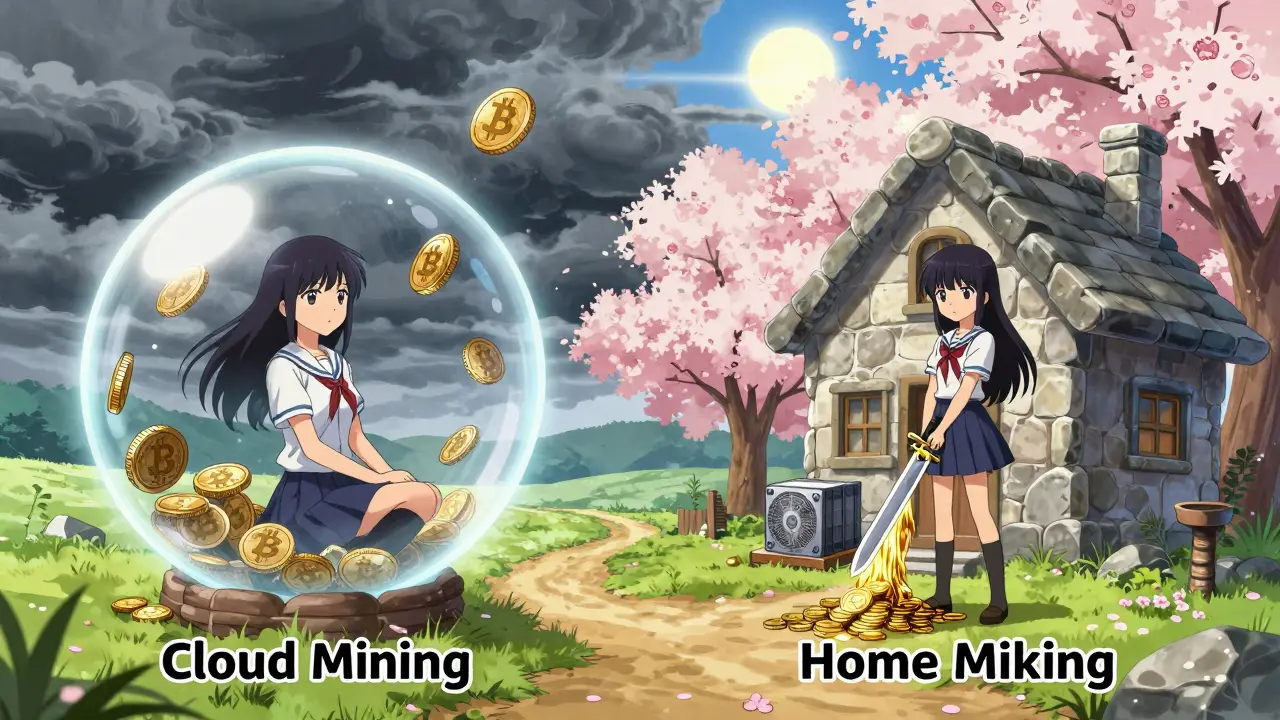

When you think about mining Bitcoin or other cryptocurrencies, two paths come up again and again: cloud mining and home mining. One promises ease-just pay, click, and wait for profits. The other demands hardware, wiring, and patience. But which one actually makes sense in 2026? It’s not about which is easier. It’s about which fits your money, your tech skills, and your electricity bill.

What Is Cloud Mining?

Cloud mining lets you rent computing power from giant data centers that mine Bitcoin for you. You don’t own any hardware. You don’t deal with heat, noise, or broken power supplies. You just sign up, pick a hash rate-say, 50 TH/s-and start earning. Providers like Bitdeer is a major cloud mining platform that offers contracts for Bitcoin hashing power with fixed durations and maintenance fees and ViaBTC is a cryptocurrency mining pool and cloud service provider that offers both cloud mining contracts and mining pool access handle everything: cooling, electricity, hardware upgrades, even security.

You pay upfront, usually for 90, 180, or 360 days. The cost? Around $0.08 to $0.15 per terahash per day, plus $0.04 to $0.08 per TH/day in maintenance fees. That adds up fast. For example, a $4,000 contract might get you 150 TH/s for a year. Sounds simple? It is. But here’s the catch: you’re locked in. You can’t switch mining pools. You can’t update firmware. You can’t even see the actual machines mining for you. All you get is a dashboard showing your estimated daily earnings.

What Is Home Mining?

Home mining means buying your own ASIC miner-like the Bitmain Antminer S21 is a high-efficiency Bitcoin mining ASIC released in Q1 2024 with 200 TH/s hash rate and 18.5 J/TH energy efficiency-plugging it into your wall, and letting it run 24/7. This isn’t a hobby for casual users. It’s a mini-factory in your garage. You need a dedicated 240V circuit. You need ventilation. You need to monitor temperatures. You need to know how to set up a mining pool and tweak settings like voltage and frequency.

A single S21 costs between $2,500 and $3,800. Add a power supply, cooling fans, and mounting gear, and you’re looking at $4,200 total. But once it’s running, your only ongoing cost is electricity. If you live in a place with cheap power-say, $0.07 per kWh-you can break even in under 10 months. At $0.15/kWh? You’re barely breaking even, if at all. And if your miner dies after 18 months? You’re out the cash. No refunds. No replacements.

Costs Compared: Upfront vs Ongoing

Let’s break it down plainly.

| Factor | Cloud Mining | Home Mining |

|---|---|---|

| Upfront Cost | $0-$5,000 (contract fee) | $3,500-$5,000 (ASIC + accessories) |

| Monthly Ongoing Cost | $12-$25 (maintenance + power) | $20-$100 (electricity only) |

| Hardware Lifespan | Managed by provider (18-24 months) | 18-24 months (you replace it) |

| Control Over Equipment | None | Full control |

| Profit Potential (at $0.08/kWh) | Lower due to fees | Higher by 15-20% |

| Profit Potential (at $0.20/kWh) | Higher by 27-33% | Lower |

Here’s the real math: if your electricity costs less than $0.10 per kWh, home mining almost always beats cloud mining. But if you’re paying $0.18 or more-like in New Zealand, Hawaii, or California-cloud mining starts to look smarter. Why? Because cloud providers have deals with power companies that cut their costs by 30-35%. You don’t get those rates. They do.

Control and Flexibility: Who Really Owns the Mining?

Home miners own their machines. That means they can:

- Switch mining pools to find the best rewards

- Undervolt their ASICs to save 12-15% on power

- Upgrade firmware to fix bugs or improve efficiency

- Sell the miner if Bitcoin crashes or electricity prices spike

Cloud miners? Not so lucky. Your contract says you get 100 TH/s. But what if they quietly downgrade you to 80? You won’t know until your payout drops. You can’t change pools. You can’t touch the hardware. You’re at the mercy of the company’s policies-and their honesty.

And here’s the scary part: 63% of fraudulent mining platforms in 2023 were cloud mining services. They took your money, promised rewards, and vanished. The IC3 is the Internet Crime Complaint Center, a division of the FBI that tracks cybercrime, including fraudulent cloud mining scams recorded average losses of $1,850 per victim. Even legit providers like Bitdeer have had complaints about contract terminations and delayed payouts.

Reliability and Support

Home mining is noisy, hot, and often frustrating. You’ll spend hours on Reddit’s r/BitcoinMining troubleshooting a dead PSU or a miner that won’t connect. But the community is huge. Over 350 questions get answered daily. Most get replies within 24 hours.

Cloud mining support? Mixed bag. Bitdeer resolves 82% of tickets in 48 hours. Sounds good? Until you realize 33% of users report communication breakdowns during disputes. And if your contract ends? You’re on your own. No one’s going to help you recover lost earnings.

On the flip side, home miners who’ve been at it for a year know how to spot a failing fan or a voltage spike. They’ve learned to read their miner’s logs like a mechanic reads a car’s dashboard. Cloud miners? Most have no idea what a hash rate even means.

Regulation and Risk

Things are changing fast. In October 2024, the SEC ruled that some cloud mining contracts are unregistered securities. Seventeen platforms shut down their U.S. operations overnight. Home mining? Still legal-but California now charges extra fees if you use more than 2,000 kWh/month for mining. That hits anyone running more than one S19.

And here’s the quiet truth: 43% of cloud mining providers don’t have enough cash reserves to survive a 50% drop in Bitcoin’s price. If Bitcoin crashes, they stop paying. You’re out. Home miners? If Bitcoin crashes, they just turn off the miner. They didn’t lose money on a contract. They still own the hardware. It’s worth something-even if it’s just scrap metal.

Who Should Choose What?

Let’s make this simple.

Choose cloud mining if:

- You have no technical experience

- Your electricity costs more than $0.15/kWh

- You want to test mining without spending $4,000

- You’re okay with low returns and zero control

Choose home mining if:

- You have cheap electricity (under $0.10/kWh)

- You’re willing to learn how to fix hardware

- You want to own your profits, not rent them

- You’re okay with noise, heat, and occasional breakdowns

Most people who try cloud mining get hooked by the ease. But after their contract ends? Only 41% of users renew. Why? Because the returns just aren’t worth it. Meanwhile, home miners with access to low-cost power are still making $120-$180 a month per miner-even after two years.

The Future of Mining

By 2026, cloud mining will grow. More people will hop on because mining is getting harder. ASICs are more expensive. Electricity is more regulated. But home mining isn’t disappearing. It’s just getting pickier. It’s now only viable in places with cheap power, strong cooling, and tech-savvy owners.

New tech is helping. Canaan’s Avalon A1466 Pro runs at 45 dB-quieter than a refrigerator. That’s a game-changer for home miners tired of noise complaints. And cloud providers are now offering carbon-neutral contracts. Bitdeer now ties each 100 TH/s contract to 1.2 MWh of verified renewable energy. That’s good for the planet. But does it make you more money? No.

So what’s the bottom line? If you want to make money mining Bitcoin in 2026, you need two things: cheap electricity and control. Cloud mining gives you none of that. Home mining gives you both-if you’re ready to earn it.

Will Lum

February 13, 2026 AT 18:35bala murali

February 15, 2026 AT 15:48Gaurav Mathur

February 16, 2026 AT 18:17Jeremy Lim

February 18, 2026 AT 11:47John Doyle

February 20, 2026 AT 08:57kelvin joseph-kanyin

February 22, 2026 AT 03:20Crystal McCoun

February 22, 2026 AT 04:20Elijah Young

February 23, 2026 AT 03:17Beth Trittschuh

February 24, 2026 AT 18:34Benjamin Andrew

February 25, 2026 AT 10:23Donna Patters

February 25, 2026 AT 14:51Michelle Cochran

February 26, 2026 AT 13:06monique mannino

February 26, 2026 AT 16:59Peggi shabaaz

February 27, 2026 AT 02:16Holly Perkins

February 28, 2026 AT 18:38Sanchita Nahar

March 2, 2026 AT 02:47Ben Pintilie

March 3, 2026 AT 20:58Sakshi Arora

March 4, 2026 AT 21:16