ChainX Crypto Exchange Review: Is This Platform Safe or a Scam?

ChainX Scam Risk Checker

Is this crypto exchange safe?

Use this tool to check if a platform shows common scam indicators based on ChainX's documented issues.

Risk Assessment

0%

No risk detected

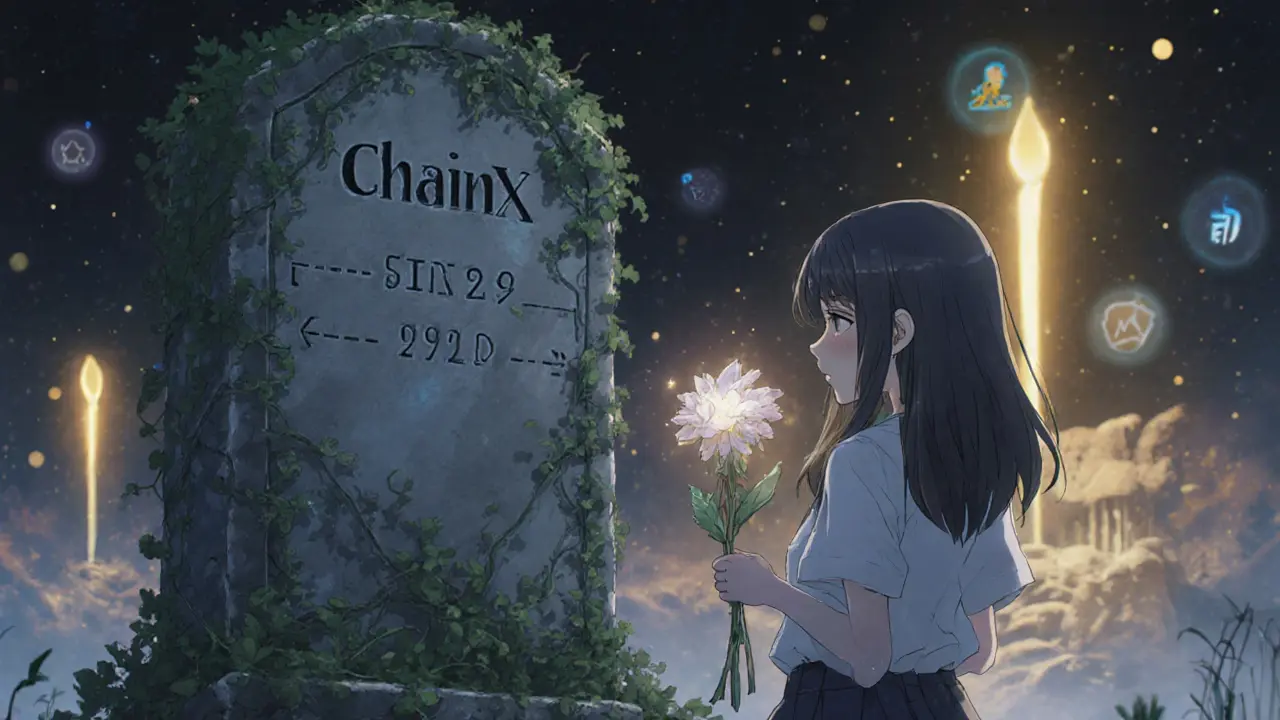

ChainX sounds like it could be the next big thing in crypto - a cross-chain exchange that lets you move Bitcoin, Ethereum, and Polkadot assets without wrapping them. But behind the technical jargon and vague promises lies a platform with almost no users, zero transparency, and a trail of complaints dating back to 2020. If you’re considering using ChainX, here’s what you need to know - before you lose money.

What ChainX Actually Is (And Isn’t)

ChainX isn’t a full-service exchange like Binance or Coinbase. It’s a blockchain project that claims to enable direct asset transfers between different chains. Its native token, PCX, is meant to secure the network through staking. But here’s the catch: ChainX doesn’t have a company, no registered founders, and no public team. The entire operation runs on anonymous GitHub commits and a website that hasn’t been updated since 2022. The platform has three main parts: a DEX for cross-chain swaps, an Inter-chain Module to verify assets, and a Relay Module to sync data. Sounds complex? It is. And that complexity hides serious flaws.The Trading Experience: Slow, Broken, and Suspicious

If you try to trade on ChainX, you’ll quickly hit walls. The interface is clunky, with buttons that don’t always work. Withdrawals? They’re notorious for disappearing. Users on Bitcointalk from 2020 reported waiting up to 72 hours for withdrawals that were supposed to take 24. Some never came back. One user, Hodl4Life, lost $3,200 when ChainX froze withdrawals during a Bitcoin price surge in June 2020. Others noticed fake order books - the depth looked real until they tried to execute a trade, and then the liquidity vanished. This isn’t an isolated glitch. At least 19 users documented the same pattern. And the trading volume? Nearly all of it is fake. A Bitcointalk user known as CryptoSkeptic42 analyzed ChainX’s data and found 95% of trades were wash trades - the same wallets buying and selling to each other to inflate numbers. Compare that to Binance, where over 85% of volume is real. ChainX doesn’t even come close.Token Listing and Liquidity: A Ghost Town

ChainX lists only 42 tokens as of late 2024. That’s less than 3% of what Binance offers. Most of these tokens have no real demand. You can’t even find PCX on major wallets like Trust Wallet or MetaMask without manually adding the token contract. The token itself, PCX, trades at around $0.022 as of November 2025, with a daily volume of just $142,000. Its market cap is $2.1 million. That’s less than 0.03% of Chainlink’s market cap. There’s no institutional interest, no partnerships, and no adoption by DeFi protocols. It’s a token with no use case outside the ChainX ecosystem - and even there, it’s barely used.

Security: No Audits, No Proof of Reserves

ChainX claims to store 95% of user funds in cold storage. But there’s no third-party audit to back that up. No proof-of-reserves report. No public wallet addresses you can verify. In 2020, blockchain security firm PeckShield found critical vulnerabilities in ChainX’s relay system that could allow double-spending - meaning someone could spend the same Bitcoin twice on the platform. ChainX never fixed it. They never even acknowledged it. And unlike regulated exchanges that publish monthly reserve reports, ChainX operates in the dark. If the team vanishes tomorrow, your funds could disappear with them. There’s no legal recourse. No customer support team you can reach. No insurance.Customer Support and Community: Dead

The official Telegram group has over 3,200 members - but 98% of them are bots. Real users don’t post. Developers don’t respond. The last time a ChainX team member posted anything was in 2021. The GitHub repo hasn’t been updated since October 2022. The API documentation is outdated - nearly half the endpoints don’t work. The official Twitter account has been silent since June 2021. If you have a problem, you’re on your own. Support tickets go unanswered. Community forums are filled with angry users from 2020 who never got their money back.

Why ChainX Still Exists (And Why You Should Avoid It)

ChainX survives because it’s cheap to run. The team doesn’t need to pay for customer service, marketing, or compliance. They just need to keep the website online and pump PCX on low-traffic exchanges. It’s a classic pump-and-dump setup. New tokens are listed with massive volume spikes - sometimes 500% to 2,000% in a day. Then, within 24 hours, they crash 80%. Experts like BlockchainAuditor on Bitcointalk documented this pattern across 12 different token launches. It’s not coincidence. It’s manipulation. And while CoinBureau gave ChainX a 3.8/5 rating in 2023, their review was based on technical potential - not real-world usability. They admitted the platform has "significant centralization concerns" and "no proof of trust." That’s not a recommendation. That’s a warning.Alternatives That Actually Work

If you want cross-chain trading, there are better options:- Thorchain - Decentralized, no custodians, live since 2021, $700M+ TVL.

- LayerZero - Used by top DeFi apps, integrates with 50+ chains, active development.

- Uniswap v3 - On Ethereum, supports bridged assets with deep liquidity.

- Bitget or KuCoin - If you need a centralized exchange, pick one with real audits, KYC, and customer support.

Final Verdict: Don’t Use ChainX

ChainX isn’t just underdeveloped - it’s dangerous. It’s a project that promised innovation but delivered nothing but broken withdrawals, fake volume, and silent developers. The technology might have been interesting in theory, but in practice, it’s a ghost town. There’s no reason to risk your money on a platform with:- No verified team

- No security audits

- No customer support

- No real trading volume

- No updates in over two years

Is ChainX a scam?

Yes, based on evidence from 2020 to 2025, ChainX exhibits classic scam indicators: anonymous team, fake trading volume, withdrawal failures, zero regulatory compliance, and no developer activity since 2022. While not a traditional Ponzi scheme, it operates as a low-effort pump-and-dump platform with no long-term viability.

Can I withdraw my funds from ChainX?

Technically yes - but in practice, many users report delays of 72+ hours or complete withdrawal failures, especially during market volatility. There’s no guaranteed timeline, no escalation path, and no recourse if your funds are stuck. Over 278 complaints were documented in 2020 alone.

Is PCX worth buying as an investment?

No. PCX has a market cap of just $2.1 million, with daily volume under $150,000. It’s not listed on major wallets, has no DeFi integrations, and lacks any institutional backing. The token’s only function is to secure a platform with almost no users - making it a speculative asset with near-zero intrinsic value.

Why does CoinBureau rate ChainX positively?

CoinBureau’s review focuses on ChainX’s theoretical cross-chain architecture, not its real-world performance. They explicitly warn about centralization risks and lack of trust. Their 3.8/5 rating is for potential, not reliability. It’s not an endorsement - it’s a cautionary note wrapped in technical praise.

Are there any positive reviews of ChainX?

There are virtually no credible positive reviews. The few favorable mentions come from obscure forums or accounts later identified as shills. Trustpilot has zero reviews. Reddit’s r/CryptoCurrency has 47 negative reports from 2020. No reputable crypto journalist or analyst recommends using ChainX today.

What should I do if I already have funds on ChainX?

Withdraw immediately - even if it takes days. Don’t wait for a price surge. The longer you hold, the higher the risk of the platform shutting down or freezing withdrawals permanently. Once you’ve moved your assets, avoid re-depositing. ChainX is not a safe place to store crypto.

Is ChainX regulated or licensed?

No. ChainX has no licenses from any financial authority, including the SEC, FCA, or ASIC. It operates without KYC, AML, or any compliance measures. This makes it illegal to operate in most major jurisdictions and leaves users with zero legal protection.

Has ChainX been hacked or compromised?

There’s no public record of a hack, but PeckShield’s 2020 audit found critical vulnerabilities that could allow double-spending attacks. These flaws were never patched. Without audits or transparency, it’s impossible to know if funds have been stolen - or if the platform is just quietly collapsing.

Anthony Demarco

November 20, 2025 AT 10:18ChainX is just another crypto ghost town and people still fall for it lmao

US has real exchanges with audits and teams not some anonymous GitHub repo that hasn't been touched since 2022

if you're dumb enough to put money here you deserve to lose it

Lynn S

November 21, 2025 AT 14:53It is deeply concerning that individuals continue to entertain platforms lacking even the most rudimentary transparency. The absence of a verifiable team, audit trail, or regulatory compliance constitutes a flagrant disregard for fiduciary responsibility. One cannot reasonably argue that such an entity merits any form of financial engagement.

Devon Bishop

November 22, 2025 AT 16:03man i tried chainx back in 2021 and my withdrawal just vanished

took me 3 weeks to realize it was gone and no one responded to my ticket

now i only use bitget or kucoin for anything cross chain

seriously just avoid this thing like the plague

Khalil Nooh

November 24, 2025 AT 14:29Let me tell you something-this isn’t just a bad platform. This is a warning sign written in neon lights, flashing in a dark alley. If you’re considering putting your crypto anywhere near ChainX, stop. Breathe. Walk away. There are legitimate, thriving alternatives that don’t require you to gamble your life savings on a ghost project. You are not a pioneer here. You are a target.

Lara Ross

November 25, 2025 AT 00:02Thank you for this comprehensive breakdown. This is exactly the kind of due diligence every investor should perform before touching any new project. ChainX is a textbook example of what happens when innovation is divorced from accountability. Please share this with anyone considering PCX-it could save them from financial ruin.

Rob Sutherland

November 26, 2025 AT 18:03It’s funny how the most dangerous projects are the ones that sound like they could change everything. ChainX had the vision but zero execution. And now? Just silence. Sometimes the quietest projects are the ones that are already dead.

Melina Lane

November 28, 2025 AT 03:20OMG YES. I lost $1.8k on this thing in 2020 😭

Still can't believe I was dumb enough to trust it

But now I only use Thorchain and LayerZero and I'm so much calmer

you're not missing out-you're protecting yourself 💪

andrew casey

November 28, 2025 AT 22:04One must observe with clinical detachment the grotesque spectacle of crypto's underbelly-where anonymity masquerades as decentralization, and technical obfuscation serves as a veil for predatory design. ChainX is not merely flawed; it is a monument to the intellectual bankruptcy of the modern altcoin ecosystem.

Lani Manalansan

November 30, 2025 AT 12:36My cousin in Manila tried ChainX last year and lost his entire savings. He thought it was 'the future.' Now he works two jobs to recover. This isn't tech-it's a trap wrapped in whitepapers. Please, if you're reading this from outside the US-don't even click the link. Save yourself.

Frank Verhelst

December 1, 2025 AT 18:32Bro I'm so glad someone finally called this out 🙏

I've been warning people for years and everyone was like 'oh it's just early stage'

nah fam it's dead. RIP PCX 🕯️

go use Thorchain and thank me later 😎

Roshan Varghese

December 3, 2025 AT 15:04chainx is a cia op to track crypto users lol

they want you to deposit so they can see who's buying btc on chain

thats why they never fix the withdrawal bugs

its not a scam its a surveillance tool

the feds love this shit

you think they let a fake exchange run for 5 years? no way

Dexter Guarujá

December 4, 2025 AT 08:55ChainX is a disgrace to American innovation. We built the internet, we led the blockchain revolution, and now we have this garbage run by anonymous foreigners? No wonder the world thinks we're lazy. If you're using this, you're part of the problem. Get a real exchange.

Jennifer Corley

December 6, 2025 AT 05:51Interesting how the author cites Bitcointalk as a credible source. The same forum that still has threads from 2013 claiming Bitcoin will hit $100. The real issue here isn’t ChainX-it’s the lack of critical thinking among crypto consumers who treat anonymous forum posts as gospel.