Hyperliquid is a fast decentralized crypto exchange, but its $700K hack by North Korean hackers and lack of reimbursement make it too risky for most users. Learn what's broken and how to protect yourself.

Cryptocurrency Reviews

When you dive into Cryptocurrency Reviews, a curated set of analyses on crypto exchanges, tokens and related services. Also known as crypto reviews, it helps traders separate solid platforms from hype. In this space, a crypto exchange, a platform that lets users buy, sell and swap digital assets often serves as the first point of contact, while a decentralized exchange, an on‑chain marketplace without a central authority offers a different risk‑return profile. Finally, a token, any digital asset built on a blockchain can be the subject of its own deep dive. Together these entities shape the crypto landscape, and understanding how they interact is key to smart investing.

One core idea is that Cryptocurrency Reviews encompass both exchange analysis and token vetting. An exchange review typically looks at security features (like two‑factor authentication and cold storage), fee structures (maker vs taker, withdrawal costs) and liquidity depth (how easily can you move large positions). A token review, on the other hand, digs into the project’s tech stack, tokenomics, supply metrics and community health. This dual focus mirrors the real‑world decision flow: you first pick a platform you trust, then you assess the assets you’ll trade on it. By linking exchange security to token risk, reviewers give you a clearer picture of overall exposure.

Why these reviews matter for Australian traders

Australia’s regulatory environment adds an extra layer to the review process. Local exchanges must align with AUSTRAC reporting, while many DEXs operate beyond borders, raising questions about compliance and user protection. Our collection highlights which platforms meet Australian standards and which rely on global jurisdictions. We also flag tokens that comply with local securities law versus those that tread into gray areas. This context helps you avoid costly mistakes and stay on the right side of the law.

Security isn’t a one‑time checkbox; it’s an ongoing practice. That’s why each exchange review includes a “risk monitoring” section, outlining past incidents, bug bounty programs and how quickly the team patches vulnerabilities. For tokens, we examine contract audits, upgradeability, and any red‑flag events like sudden token burns or unexplained supply changes. By weaving these attributes together, the reviews provide a holistic risk assessment rather than isolated data points.

Fees play a surprisingly big role in long‑term profitability. A 0.2% taker fee versus a 0.5% fee can shave off thousands of dollars on high‑volume trades. Our exchange analyses break down fee tiers, incentives for holding native tokens, and hidden costs such as withdrawal minimums. Token reviews also cover minting or burn fees that might affect your net return. Understanding these nuances lets you optimize both short‑term trades and long‑term holdings.

Liquidity is another thread that runs through every review. High liquidity means tighter spreads and less slippage, which is crucial for large orders or volatile assets. We compare order‑book depth, automated market maker (AMM) pool sizes and cross‑chain bridging options for each platform. For tokens, we look at market cap, circulating supply and the presence of liquidity mining programs. These metrics help you gauge how easily you can enter or exit a position without moving the market.

Finally, community sentiment often predicts future developments. Exchange reviews cite user forums, social media activity and support response times. Token reviews discuss developer activity on GitHub, roadmap transparency and partnership announcements. By mapping community health to platform performance, the reviews give you a pulse on where the market might head next.

Below you’ll find a hand‑picked list of our latest reviews, from the Coinbook exchange to the Blackhole DEX and from MM Finance token to Falcons (FAH). Each article follows the same rigorous template, so you can quickly compare security, fees, liquidity and overall trustworthiness. Whether you’re a beginner looking for a safe entry point or an experienced trader hunting the next high‑yield token, the resources here are built to guide your next move.

What is Skimask Pnut (SKINUT) crypto coin? A reality check on this meme token

Skimask Pnut (SKINUT) is a meme coin on the Base Network with minimal trading volume, massive price declines, and no major exchange support. It's not a scam-but it's not an investment either.

SmarDex Crypto Exchange Review: The Everything Protocol Shift in 2026

SmarDex has evolved into the Everything Protocol - a unified DeFi platform combining swaps, lending, and leveraged trading. Learn how it works, its risks, and whether it's worth using in 2026.

KyberSwap Elastic on Avalanche: A Deep Review of the Most Efficient DeFi Exchange for Cross-Chain Swaps

KyberSwap Elastic on Avalanche offers unmatched capital efficiency and auto-compounding yields for DeFi users. With $0.08 gas fees, 1.8s swaps, and 23% higher APY than competitors, it's the most efficient DEX for active traders and liquidity providers.

VALR Crypto Exchange Review: Fees, Security & Best Use Cases in 2026

VALR is a South African crypto exchange offering easy trading with low fees and strong security. While it's great for beginners in Africa, it has limited global availability and educational resources. Find out if it's right for you.

What is AVINOC (AVINOC) Crypto? Current Status & Risks Explained

AVINOC promised to revolutionize business aviation with blockchain. Today, its price has dropped 99% from peak, with minimal adoption and user complaints. Learn why this token is considered a high-risk investment.

What is Beercoin 2 (BEER2) Crypto Coin? The Truth Behind the Solana Memecoin

Beercoin 2 (BEER2) is a Solana-based memecoin relaunched after its predecessor crashed. With minimal liquidity, no real utility, and no exchange listings, it's a high-risk speculative token - not an investment.

QuickSwap v3 (Polygon) Crypto Exchange Review: Fees, Speed, and Real-World Performance

QuickSwap v3 on Polygon offers near-zero fees and fast swaps, making it the top DEX for Polygon users. Learn how it compares to Uniswap, how to use it, and whether it's worth your time.

Thore Exchange Crypto Exchange Review: Is It Safe or Worth Using in 2026?

Thore Exchange is a little-known crypto platform with no mobile app, no user reviews, and zero transparency on security or fees. In 2026, it's not worth risking your funds on.

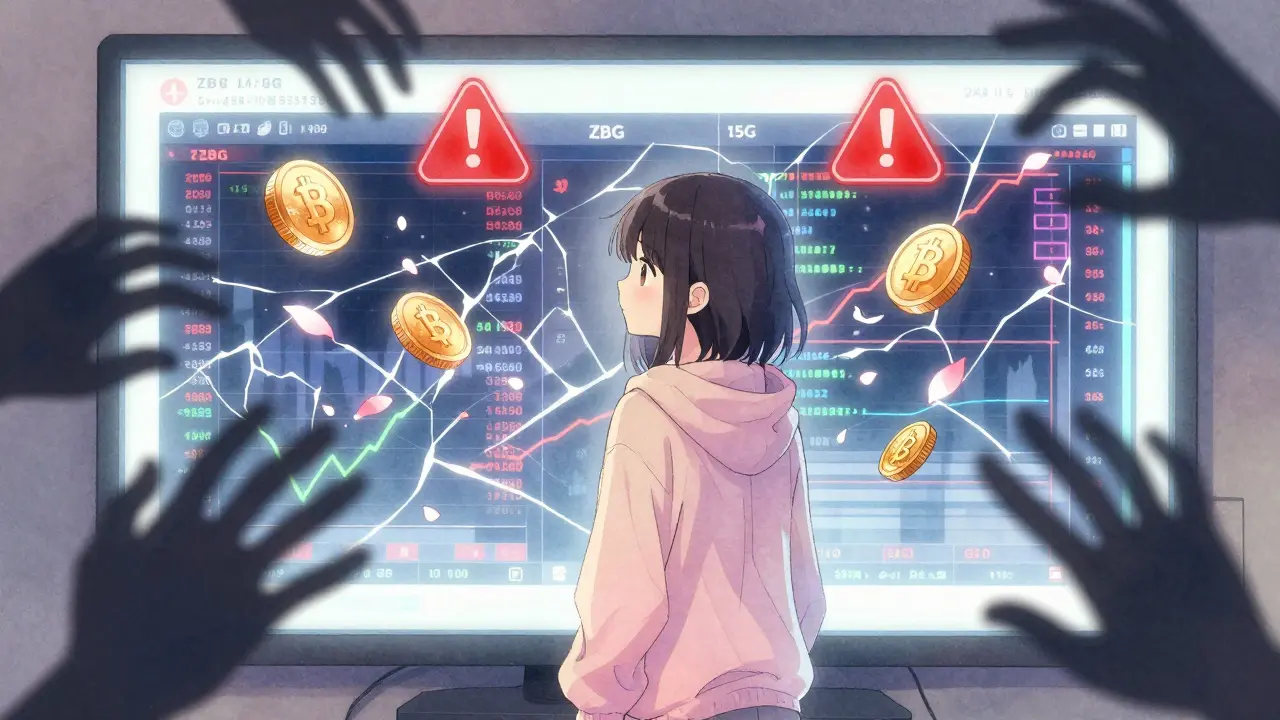

ZBG Crypto Exchange Review: High Risk, Low Transparency

ZBG crypto exchange claims high volume and low fees, but its untracked data, hidden fees, and lack of regulation make it a high-risk platform. Avoid ZBG and choose transparent, verified exchanges instead.

iZiSwap (Mode) Crypto Exchange Review: Zero Fees, Tiny Liquidity, and Real-World Trade Risks

iZiSwap (Mode) offers zero fees and zero slippage on paper, but with only $171 daily volume and 4 supported tokens, it's unusable for most traders. A technical experiment, not a real exchange.

TCHApp Crypto Exchange Review: Is This New Platform Worth Trying in 2025?

TCHApp Crypto Exchange has a 4/5 rating from just one review. Is it safe or just too new to trust? Learn what’s known - and what’s dangerously missing - about this little-known platform in 2025.