Russian citizens face severe crypto exchange restrictions in 2025. Only the wealthy can legally trade. Most rely on risky P2P platforms and VPNs. Here's what works, what doesn't, and why the system is failing.

Russian crypto restrictions: What’s banned, who’s affected, and how it compares to global crackdowns

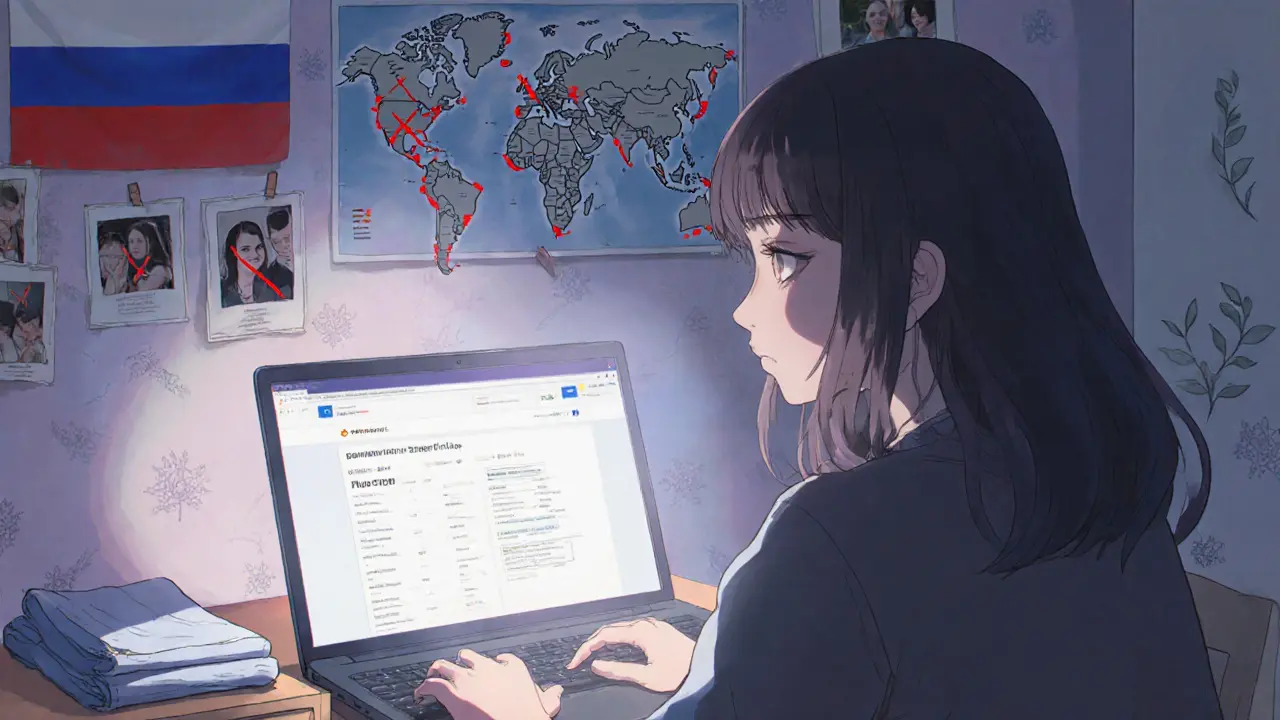

When it comes to Russian crypto restrictions, a set of laws and enforcement actions that limit the use, trading, and mining of cryptocurrencies within Russia’s borders. Also known as crypto crackdown in Russia, these rules are among the strictest in the world—not because Russia hates technology, but because it wants full control over money flows. Unlike countries that ban crypto outright, Russia walks a tightrope: it forbids crypto as payment but lets you hold and trade it privately. That’s not a loophole—it’s a trap. The government doesn’t want you using Bitcoin to avoid sanctions, but it’s fine if you speculate on it in your wallet.

This policy ties directly to crypto regulations Russia, the legal framework enforced by the Central Bank of Russia and the Ministry of Finance that defines what’s allowed and what’s punishable. Also known as Russia’s digital asset laws, these rules were tightened in 2022 after the invasion of Ukraine, when Western sanctions made crypto a potential lifeline for bypassing financial controls. The Central Bank pushed hard to block crypto exchanges from operating legally, and by 2023, platforms like Binance and Kraken were blocked from advertising or onboarding Russian users. Mining? Still technically legal, but energy prices were hiked so high that most miners shut down or fled to Kazakhstan and Georgia.

What about cryptocurrency ban Russia, the outright prohibition of using digital currencies to pay for goods or services. Also known as crypto payment ban, this rule targets everyday use—not speculation. If you try to buy a laptop with Bitcoin at a Moscow store, you’re breaking the law. The government doesn’t care if you own it; they care if you spend it. That’s why Russian traders now use peer-to-peer platforms like LocalBitcoins or P2P on Binance, often paying in cash or bank transfers to avoid detection. It’s risky, but it works—until you get caught. Fines can hit $10,000, and repeated violations can lead to asset seizures or criminal charges.

Compare this to crypto trading Russia, the underground ecosystem where Russians buy, sell, and hold crypto despite legal gray zones. Also known as Russia’s crypto black market, this space is alive with Telegram bots, VPNs, and offshore wallets. It’s not a free-for-all—people are cautious. Many use the Russian ruble’s digital version, the digital ruble, as a bridge between fiat and crypto. But even that’s not a safe escape. The government tracks every transaction, and if your crypto activity looks suspicious, you’ll get a visit.

And it’s not just Russia. Algeria, Tunisia, Cambodia—each has its own version of this crackdown. Algeria jails traders. Tunisia locks them up for five years. Cambodia bans banks from touching crypto. Russia? It’s more surgical. It doesn’t ban crypto—it just makes using it dangerous. That’s why so many Russians now hold crypto like a secret weapon: not to spend, but to survive.

Below, you’ll find real cases, broken exchanges, and scams that thrived under these rules. Some posts expose fake airdrops targeting Russians. Others show how local traders got burned by unregulated platforms. This isn’t theory. It’s what happened when governments tried to control money that was never meant to be controlled.