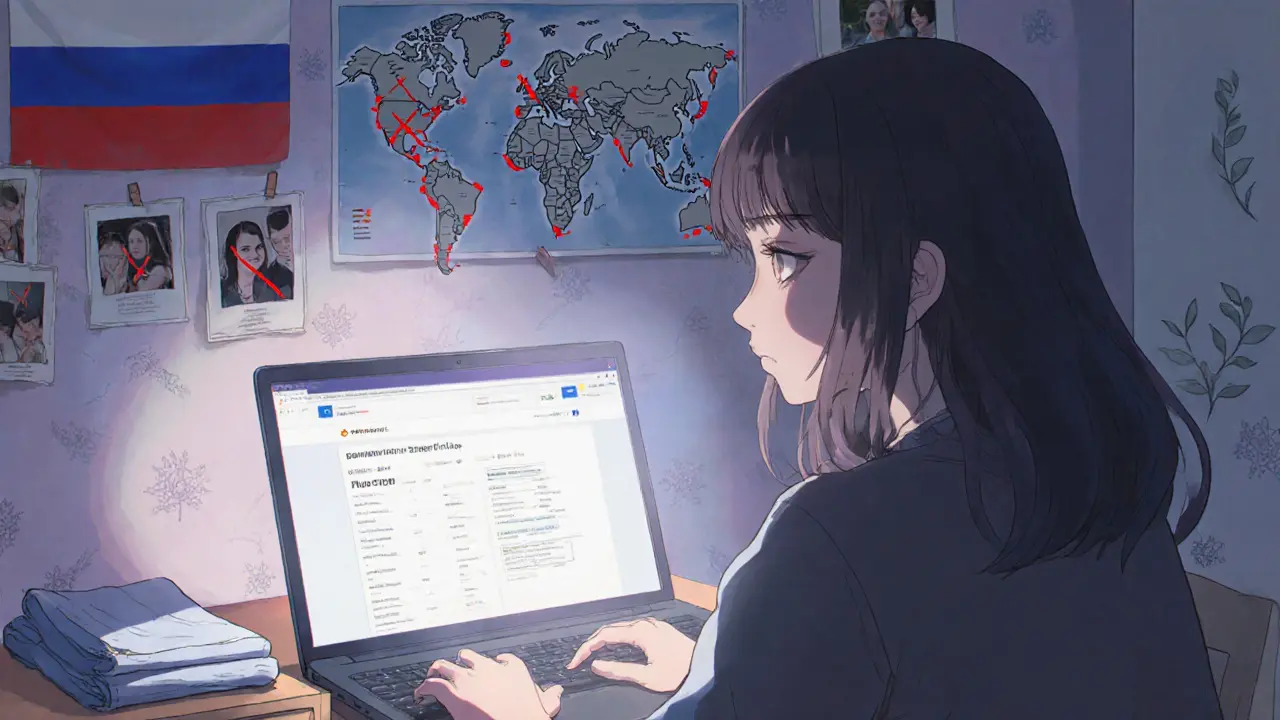

Russian citizens face severe crypto exchange restrictions in 2025. Only the wealthy can legally trade. Most rely on risky P2P platforms and VPNs. Here's what works, what doesn't, and why the system is failing.

Binance Russia Ban: What Happened and How It Changed Crypto in Europe

When Binance Russia ban, the 2022 decision by Binance to halt operations in Russia following international sanctions. Also known as Binance's Russia exit, it was one of the first major crypto exchanges to fully comply with geopolitical pressure, setting a precedent for how global platforms respond to state-level crypto restrictions. This wasn’t just a business move—it forced thousands of Russian users to find alternatives overnight, while regulators worldwide watched closely to see if other exchanges would follow suit.

The crypto exchange regulations, the legal frameworks that govern how platforms operate across borders. Also known as global crypto compliance rules, it became clear that exchanges couldn’t ignore sanctions without risking their licenses in the U.S., EU, and Australia. The Russia crypto ban, the Russian government’s own crackdown on cryptocurrency use for cross-border payments and foreign exchange. Also known as Russia’s financial isolation policy, made things worse—users were caught between a platform pulling out and their own government making trading risky. This double pressure turned crypto from a financial tool into a political liability in the region.

After the ban, Binance redirected its focus to compliant markets, while smaller exchanges stepped in to fill the gap—many of them unregulated and unsafe. That’s why you’ll find posts here about platforms like C-Cex and ChainX, which saw a surge in Russian traffic after Binance left. These weren’t upgrades—they were last resorts. Meanwhile, the Binance restrictions, the broader set of rules Binance began enforcing globally after the Russia incident. Also known as KYC/AML tightening, became stricter everywhere. Now, even users in Australia or Canada face tighter identity checks because Binance had to prove it wasn’t helping sanctioned users slip through the cracks.

The cryptocurrency legality, the legal status of crypto in countries facing sanctions or political isolation. Also known as crypto under sanctions, became a hot topic in places like Iran, North Korea, and later, Tunisia and Algeria—where governments now use the Russia example to justify their own bans. What happened in Russia didn’t stay in Russia. It became a blueprint.

What you’ll find below are real stories from people who lost access to their funds, reviews of the shady exchanges that popped up after the ban, and deep dives into how compliance rules now shape everything from airdrops to trading pairs. No theory. No fluff. Just what actually happened—and how it changed the game for everyone else.