Mining Crypto in Russia: Law and Restrictions in 2025

When you think about mining Bitcoin or Ethereum, you might picture a garage full of humming machines. But in Russia, that image comes with a legal warning label. Since January 1, 2025, mining crypto isn’t just about electricity and hardware-it’s about navigating a maze of regional bans, power cuts, and government tracking. The rules changed fast, and now there’s a real cost to getting it wrong.

What’s Legal and What’s Not

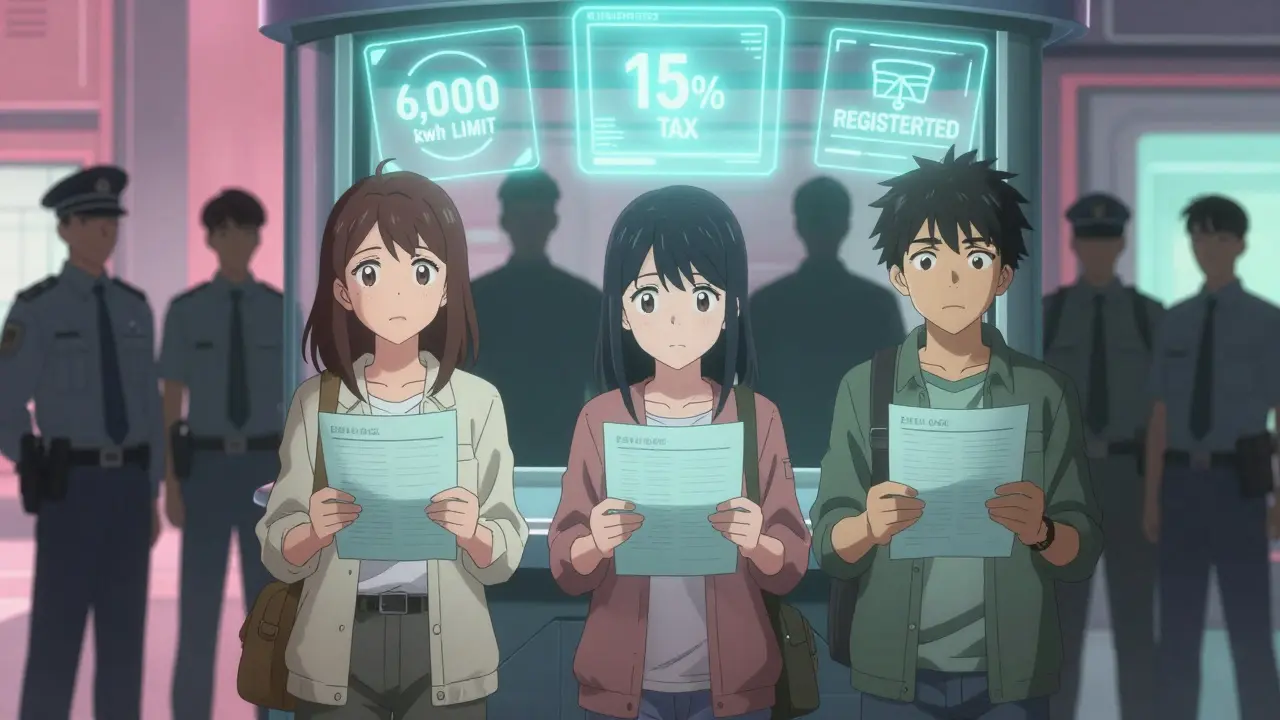

Russia doesn’t ban cryptocurrency mining outright anymore. Instead, it lets you mine-if you jump through a lot of hoops. The law now recognizes mining as a legal activity, but only if you register with the Federal Tax Service. Unregistered miners? They’re breaking the law. Fines start at 200,000 rubles (about $2,500) and can go up to 2 million rubles ($25,500) for repeat or large-scale violations. That’s not a slap on the wrist-it’s a business killer.

Here’s the twist: if you’re an individual mining at home and using less than 6,000 kWh per month, you don’t need to register. That’s roughly the power used by a small server farm running 24/7. Most hobbyists fall under this limit. But if you’re running more than that-even if you think you’re just "experimenting"-you’re now a regulated business. And that means taxes, paperwork, and government oversight.

The Power Grid Has Priority Over Your Miners

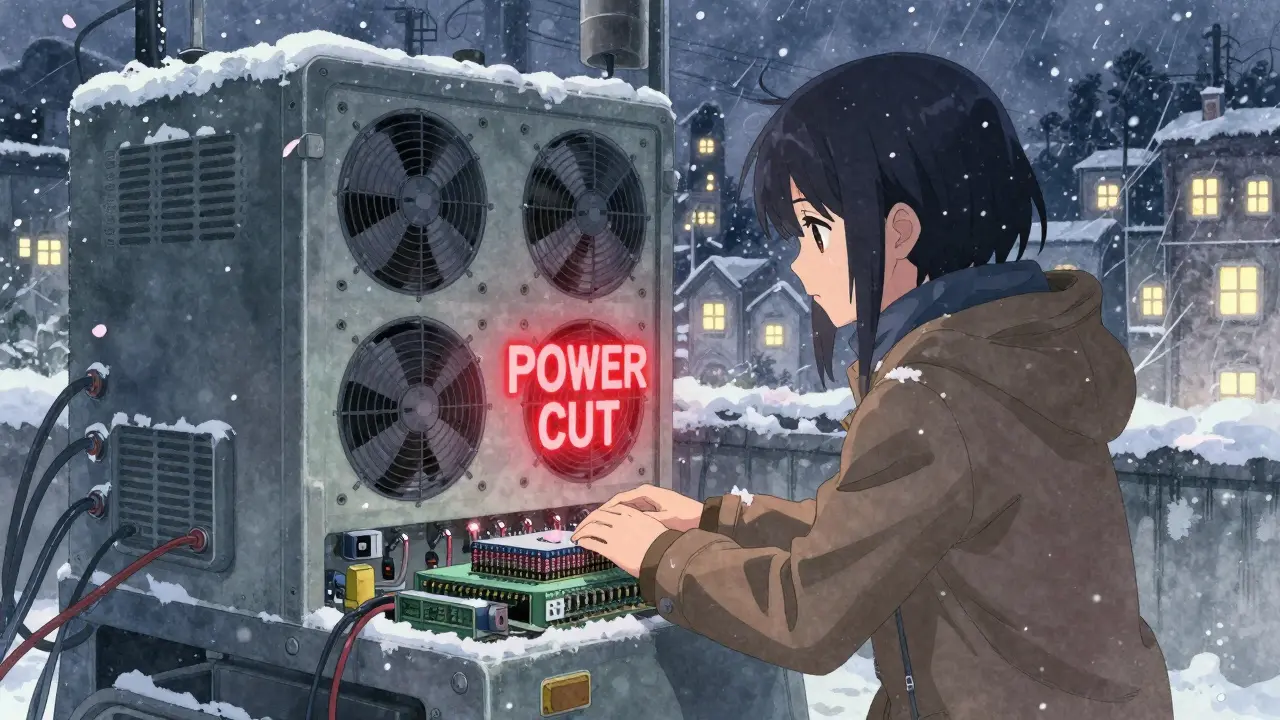

One of the most unusual parts of Russia’s system? The government can shut off your mining rigs remotely. No warning. No notice. Just a signal sent from a central server that cuts the power. Why? Because mining is classified as a "fourth category" electricity consumer-the lowest priority.

During winter, when homes are heating up and hospitals are running critical equipment, the grid prioritizes life over profit. If electricity demand spikes, mining operations in affected regions get cut first. This isn’t theoretical. In December 2024, over 120 mining farms in Siberia lost power for 72 hours during a regional cold snap. No one got compensated. No one got a refund. That’s just how the system works.

Where You Can’t Mine (And Why)

Not all of Russia is open for mining. Ten regions have a total ban that runs from January 1, 2025, through March 15, 2031. These include Dagestan, Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, North Ossetia, Chechnya, and four occupied Ukrainian territories: Donetsk, Luhansk, Zaporizhzhia, and Kherson. These areas are either energy-deficient or politically sensitive, and the government decided mining adds too much strain.

Three Siberian regions-Irkutsk, Buryatia, and Zabaikalsky-face seasonal bans. From November 15 to March 15 every year, mining is prohibited. That’s six months out of the year. The reason? These regions rely on aging power infrastructure that can’t handle winter peaks. Mining rigs pull massive loads, and the government won’t risk blackouts in cities like Irkutsk or Ulan-Ude.

Even if you’re not in one of these zones, your equipment must be registered. Every ASIC miner, GPU rig, or server rack imported into Russia now needs a state-approved label. This lets authorities track exactly how much power each device uses. If you buy gear from a friend or import it without paperwork, you’re already in violation-even before you turn it on.

Taxes and Reporting

Profits from crypto mining are now taxable. Since November 2024, Russia imposed a 15% tax on mining income. That means if you mine Bitcoin and sell it for rubles, you owe 15% of the profit. But here’s the catch: you have to prove you earned it. That requires detailed records of electricity costs, equipment depreciation, and sales receipts.

And if you’re not registered? You can’t legally report income. So many miners just don’t. As of mid-2025, only 30% of mining operations were registered with the tax authorities. That means 70% are operating in the gray zone-technically illegal, but not yet caught. The government knows this. They’re planning to increase fines to 2 million rubles to push more people into compliance.

Also, if you trade crypto for rubles and the transaction exceeds 600,000 rubles (about $7,500), you must report it. That’s not just for miners-anyone buying or selling crypto above that threshold needs to file. The goal? Keep the ruble as Russia’s only legal currency. Using Bitcoin to buy a car or pay rent? Still illegal. Mining is allowed. Spending it? Not so much.

Why So Many Miners Are Still Unregistered

Despite the laws, most miners aren’t registering. Why? Because the system is messy. The registry portal is slow. The paperwork is confusing. Many don’t trust the government to protect their assets. And some fear that registering makes them a target for audits or asset seizures.

There’s also a cultural factor. In Russia, underground tech operations have a long history. From early internet startups to peer-to-peer networks, many miners grew up in a culture of self-reliance. Registering feels like giving up control. One miner in Novosibirsk told reporters: "I don’t want them knowing where my machines are, how much I make, or when I turn them on. That’s not freedom-that’s surveillance."

But the risks are growing. Authorities now use satellite imaging and power grid analytics to detect anomalies. If a building in Omsk suddenly spikes its electricity usage by 400%, the system flags it. Then inspectors show up. No warrant needed. Just a power meter reading.

The Future: Controlled Growth

Russia’s approach isn’t about banning crypto. It’s about controlling it. The government wants to capture the economic benefits-jobs, tech investment, export revenue-without losing control of its financial system. That’s why they created the six-year ban timeline. It’s not just punishment-it’s a test. If energy infrastructure improves by 2031, some bans might lift. If not, they’ll extend.

For miners, the message is clear: if you want to play, you have to play by their rules. Register. Pay taxes. Stay under the power limit. Don’t mine in banned regions. And never assume you’re invisible.

Some companies are adapting. A few mining farms now operate in legal zones like Krasnodar or Kaluga, where power is abundant and regulations are clearer. They’ve hired compliance officers, installed government-approved meters, and even partnered with regional energy providers. These operators are thriving. The ones still hiding? They’re playing Russian roulette with their equipment-and their wallets.

What You Should Do

If you’re thinking about mining in Russia:

- Check if your region is banned. The 10 permanent bans and 3 seasonal zones are public. Don’t guess.

- Calculate your monthly power use. If it’s under 6,000 kWh, you’re exempt from registration-but still taxed if you sell.

- Only buy equipment with official Russian certification. No gray-market gear.

- Keep detailed records of electricity bills, equipment purchases, and sales. You’ll need them.

- Don’t assume you’re safe just because you haven’t been caught. The tracking system is getting smarter.

Miners who follow the rules now have a real chance to profit. Those who ignore them? They’re not just breaking the law-they’re risking everything they own.

Can I mine crypto at home in Russia without getting in trouble?

Yes-if you use less than 6,000 kWh per month and don’t sell your crypto for rubles in large amounts. But if you mine more than that, or sell Bitcoin for cash, you must register with the tax authorities. Even then, your power can be cut during winter peaks if you’re in a restricted region.

What happens if I get caught mining illegally in Russia?

Your equipment can be seized, and you’ll face fines between 200,000 and 2 million rubles ($2,500-$25,500). Authorities use power grid data, satellite images, and customs records to find unregistered miners. Repeat offenders risk criminal charges.

Can the government really turn off my miners remotely?

Yes. All registered mining equipment must be labeled and connected to a national monitoring system. During power shortages, authorities can send a signal to cut electricity to mining rigs before it’s cut from homes or hospitals. This has already happened in Siberia during winter 2025.

Is mining crypto profitable in Russia right now?

It can be-but only if you’re in a legal zone, have cheap electricity, and are registered. Electricity costs vary wildly. In some regions, miners pay 3-5 rubles per kWh. In others, they pay 15 rubles or more. After taxes, equipment costs, and power cuts, profit margins are tight. Only well-run operations break even.

Can I use Bitcoin to buy things in Russia?

No. Using cryptocurrency to pay for goods or services is still illegal in Russia. The ruble is the only legal tender. You can mine Bitcoin, hold it, or sell it for rubles-but you can’t use it to buy a phone, a car, or groceries. Violations can lead to fines and account freezes.