Future Protections Against Rug Pulls in Cryptocurrency

Rug Pull Risk Assessment Tool

Enter key security metrics to determine the risk level of a cryptocurrency project.

Risk Assessment Result

Based on your inputs, the risk level of this project is:

Every year, billions of dollars vanish overnight in the cryptocurrency world-not because of market crashes, but because someone built a fake project, took your money, and disappeared. That’s a rug pull. And in 2024 alone, U.S. investors lost $9.3 billion to crypto scams, according to the FBI. Most of those were rug pulls: projects that looked real, promised big returns, and then vanished the moment they got your funds.

What Exactly Is a Rug Pull?

A rug pull happens when developers create a cryptocurrency token, hype it up on social media, get people to invest, and then suddenly remove all the liquidity from the trading pool. Without liquidity, the token can’t be sold. Its value drops to zero. And you’re left holding digital trash. There are two main types: hard and soft. A hard rug pull is fast and brutal. One day the token trades at $1, the next it’s worthless. No warning. No explanation. Just a drained liquidity pool and a GitHub repo that’s been deleted. Soft rug pulls are sneakier. The team keeps posting updates, pretending everything’s fine. They might even release a new feature or two. But behind the scenes, they’re slowly selling off their tokens, draining the pool bit by bit. By the time you notice, it’s too late. The price has already collapsed. Common tactics include:- Liquidity sweeps: Scammers add all the liquidity to a pool, wait for others to buy in, then pull it out when the price rises.

- Honeypot contracts: The code looks normal, but you can’t sell your tokens-only buy them.

- Pump and dump: Coordinated buying drives the price up, then the team sells everything.

- Team exits: Developers vanish without notice, taking their wallets and the project’s funds with them.

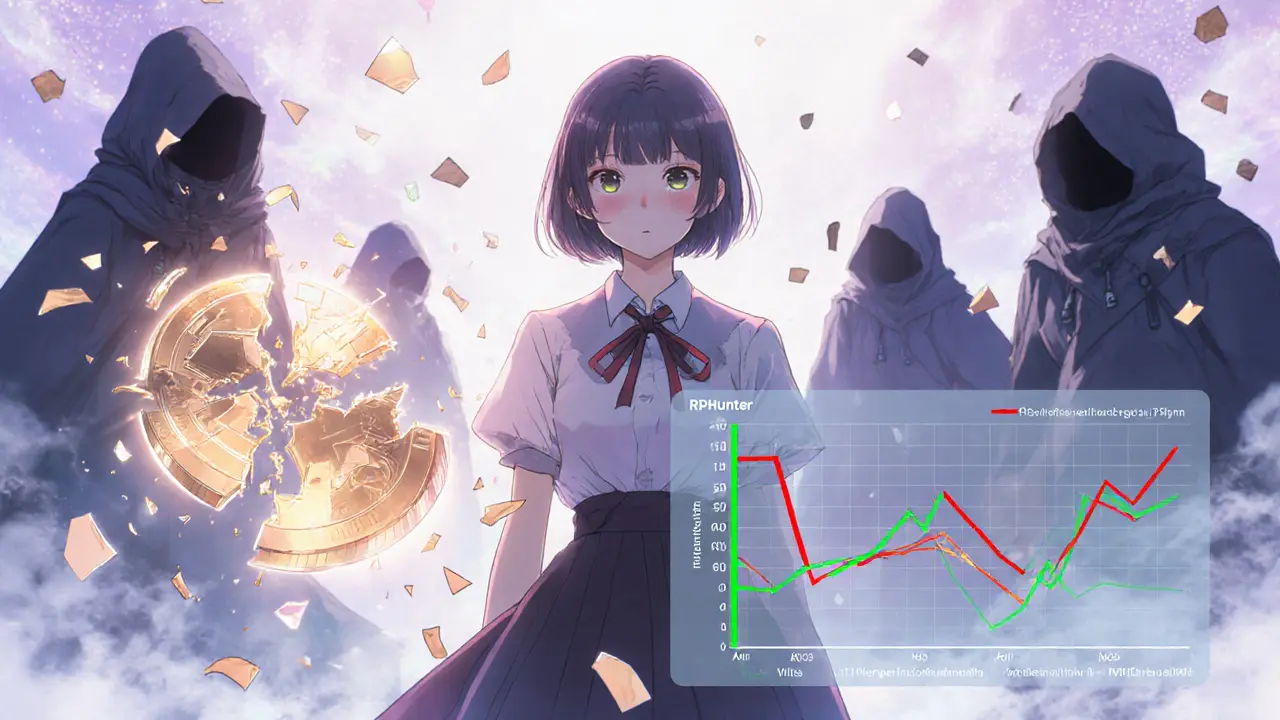

How RPHunter Is Changing the Game

In 2025, a new detection system called RPHunter is a cutting-edge AI-powered detection system that combines smart contract code analysis with real-time transaction behavior to identify rug pulls before they happen was introduced-and it’s already making waves. Unlike older tools that only check for known malicious code patterns, RPHunter looks at how code and transactions interact. It builds two graphs: one for the smart contract’s risky code structures (called the Semantic Risk Code Graph), and another for how tokens move between wallets (the Token Flow Behavior Graph). Then it uses machine learning to spot patterns that humans can’t see. The results? A 95.3% precision rate and a 93.8% recall rate on real-world rug pull cases. That means it rarely misses a scam-and rarely flags a real project by mistake. When tested on live data, RPHunter flagged over 4,800 scam tokens with 91% accuracy. That’s not just good-it’s revolutionary. For the first time, protection isn’t reactive. It’s predictive.Token Sniffer and GoPlus Security: Your First Line of Defense

You don’t need to be a coder to protect yourself. Tools like Token Sniffer is an AI-driven platform that analyzes smart contracts across multiple blockchains and assigns safety scores from 0 to 100 give you a simple number: a safety score between 0 and 100. If a token scores below 50, walk away. Above 80? It’s likely safe. It checks for:- Locked liquidity

- Ownership renunciation

- Unusual token distribution

- Hidden mint functions

Token Metrics: Seeing Beyond the Surface

Security isn’t just about code. It’s about people. A project with perfect code but a team that’s anonymous, has no track record, and never shows up on social media? That’s a red flag. Token Metrics is a crypto analytics platform that evaluates tokens using both Trader Grade and Investor Grade ratings, incorporating security, team credibility, and liquidity metrics goes deeper. It doesn’t just check for scams-it rates long-term viability. Its Investor Grade looks at:- Has the project been audited by a reputable firm?

- Are the developers identifiable? Do they have past projects?

- Is liquidity locked for more than a year?

- Is the token holder distribution concentrated in a few wallets?

Behavioral Detection: Catching Scammers Before They Act

The smartest scams don’t just vanish. They test the waters first. They’ll send small amounts to exchanges, check if anyone’s watching, then make the big move. That’s where Elliptic is a blockchain analytics firm that uses AI to detect scammer wallets through behavioral patterns across multiple blockchains comes in. Their system doesn’t just look at what’s happening-it looks at how it’s happening. A wallet that sends 90% of its holdings to a centralized exchange after holding for 48 hours? That’s a classic dump pattern. Elliptic’s tools flag these wallets automatically, even if they’re on different chains. Scammers used to jump between Ethereum, Solana, and BSC to hide. Now, cross-chain monitoring catches them. This isn’t about catching the scam after it happens. It’s about stopping it before the first big transfer.

What You Can Do Right Now

Technology helps-but it won’t save you if you ignore the basics.- Never invest based on FOMO. If a project is pushing you to “buy now” or “limited time offer,” it’s a scam.

- Check the liquidity. Is it locked? For how long? If it’s not locked-or if the lock is only for 30 days-run.

- Look at the holders. If 10 wallets hold 80% of the supply, the team can dump anytime.

- Read the contract. You don’t need to understand Solidity. Use Token Sniffer to do it for you.

- Watch for anonymous teams. If you can’t find a LinkedIn profile, GitHub history, or real name, assume it’s a front.

The Bigger Picture: Regulation and Community

Governments are starting to act. The California Department of Financial Protection and Innovation keeps a public Crypto Scam Tracker. It’s not perfect, but it’s a start. In the future, expect global cooperation-where scam data is shared across borders in real time. Communities are also becoming shields. Platforms that let users report suspicious projects and reward accurate reports are growing. Think of it like Wikipedia for crypto safety: the more people contribute, the safer it gets for everyone. But here’s the truth: no tool, no regulation, no community can replace your own judgment. If something feels too good to be true, it is. If the team won’t show their face, don’t give them your money.The Future Is Layered

There’s no single fix for rug pulls. But the future isn’t about one magic tool. It’s about layers:- Code analysis (RPHunter, Token Sniffer)

- Behavioral monitoring (Elliptic)

- Project evaluation (Token Metrics)

- Regulatory databases (Crypto Scam Tracker)

- Community reporting (user-driven alerts)

- Your own discipline (no FOMO, no blind trust)

How can I tell if a crypto project is a rug pull before investing?

Check for locked liquidity, a renounced contract, and a team with verifiable identities. Use tools like Token Sniffer to get a safety score above 80. Avoid projects with anonymous developers, high token concentration, or sudden social media hype. If the project promises guaranteed returns, it’s a red flag.

Is RPHunter available to the public?

RPHunter is currently used by major crypto exchanges and security firms for real-time monitoring. While the full system isn’t public yet, its detection logic has been integrated into platforms like Token Sniffer and GoPlus Security. You can access its benefits indirectly by using these tools.

Can I trust audit reports from firms like CertiK?

Audits help, but they’re not foolproof. Some audits are superficial, and scammers have paid for clean reports on malicious code. Always cross-check audits with other signals: liquidity locks, team transparency, and behavioral patterns. A clean audit + a 95% safety score on Token Sniffer = stronger confidence.

Why do rug pulls keep happening if there are so many detection tools?

Scammers adapt faster than regulations. As soon as a new detection method is released, they tweak their code to bypass it. That’s why tools like RPHunter use machine learning-they evolve automatically. But the biggest reason rug pulls persist is human behavior: greed, FOMO, and lack of research. No tool can fix that alone.

Are there any safe new crypto projects right now?

There’s no such thing as a guaranteed safe new project. But projects with long-term locked liquidity, audited code, transparent teams, and active communities have a much lower risk. Use Token Metrics’ Investor Grade to filter for those with strong fundamentals-not just hype. If you’re unsure, wait. The best investments aren’t the ones you jump into first-they’re the ones you understand well enough to avoid.

Kandice Dondona

November 15, 2025 AT 09:32OMG YES this is everything I’ve been screaming about!! 🙌 Token Sniffer saved my portfolio last month-caught a honeypot before I even clicked ‘approve’! If you’re new to crypto, just install the extension and don’t touch anything under 80. I’m not even joking. I cried when I saw my $2000 still intact. 🥲

Sara Lindsey

November 15, 2025 AT 13:56People still think audits = safe?? Bro that’s like trusting a car salesman who says ‘this engine is fine’ without opening the hood. RPHunter’s real magic is catching the slow burns-the ones where they drain liquidity over 3 weeks while posting ‘new feature updates’. I’ve lost money to both. Don’t get cute.

Liz Watson

November 17, 2025 AT 06:26Oh wow. Another ‘revolutionary’ tool that’ll ‘change everything’. Let me guess-next you’ll tell me blockchain will end poverty and make my ex come back. The only thing that’s ‘revolutionary’ is how easily people hand over money to strangers on the internet. Still waiting for the AI that stops me from being dumb.

Rachel Anderson

November 18, 2025 AT 20:30I’m sorry but if you need a tool to tell you not to invest in a project with 10 anonymous devs and a whitepaper written in Google Translate… maybe you shouldn’t be investing at all? This isn’t rocket science. It’s basic human decency. If they won’t show their face, why should you show your wallet?

Vanshika Bahiya

November 18, 2025 AT 22:27Just wanted to add-Vanshika here from India. I’ve been teaching crypto safety workshops for teens and seniors. The biggest red flag? ‘Guaranteed 10x in 7 days.’ I showed my grandma how to use Token Sniffer last week. She now checks every token before sharing it in her WhatsApp group. Small wins matter. 💪

Hamish Britton

November 20, 2025 AT 17:27Elliptic’s cross-chain tracking is wild. I watched a scammer try to move $4M from Ethereum to Solana to Polygon. Got flagged at the first bridge. The system didn’t just see the money-it saw the panic in the pattern. That’s not tech. That’s intuition built into code.

alex piner

November 21, 2025 AT 12:10im so glad i found this thread. i lost my rent money to a rug pull last year and i still feel like a fool. but now i use token sniffer + token metrics every time. even if the project looks legit, i wait 48 hours. if no one’s selling yet, i get nervous. weird right? but it saved me twice. thanks for the info guys

Gavin Jones

November 21, 2025 AT 16:12It’s fascinating how the layers of protection mirror societal trust structures. In pre-digital economies, reputation was the primary safeguard. Now, we’ve algorithmically replicated that through behavioral analytics. The human element-your intuition-remains irreplaceable, yet it’s now augmented by machine intelligence. A beautiful convergence.

Robert Astel

November 23, 2025 AT 00:31yo i tried rphunter last week and it flagged my favorite memecoin but it was legit!! so i was like ‘nah this thing is wrong’ and i invested anyway… turned out it WAS a rug pull 😭 i lost 3k. lesson learned. tools are your friends even when they hurt your feelings. also typoed ‘rphunter’ like 5 times in this comment. sorry.

Kelly McSwiggan

November 24, 2025 AT 05:3395.3% precision? That’s statistically meaningless if the baseline is 99% of new tokens are scams. You’re not detecting fraud-you’re just filtering the ocean of garbage to find slightly less toxic garbage. This isn’t safety. It’s damage control for the gullible.

Albert Melkonian

November 24, 2025 AT 20:07While technological solutions are vital, we must not overlook the epistemological responsibility of the investor. The belief that ‘someone else’s tool’ will absolve one of due diligence is a dangerous cognitive bias. Tools are prosthetics-not replacements-for intellectual rigor.

Andrew Parker

November 26, 2025 AT 15:54I just lost my entire life savings to a ‘secure’ token that had a CertiK audit AND a locked liquidity… and now I’m sitting here in my mom’s basement wondering if I should’ve just bought Bitcoin in 2017. I don’t even know who I am anymore. 😭💔

ratheesh chandran

November 27, 2025 AT 19:14bro i read this whole thing and still bought a token called ‘Dogecoin 2.0’ because the discord had 50k members and the dev said ‘we gon moon’… now i just stare at my phone and cry. why do i do this to myself

Becky Shea Cafouros

November 28, 2025 AT 05:28Wow. A 1200-word essay on how to not get scammed. And yet, people still do. The real problem isn’t the tools. It’s the people. No amount of AI will fix human greed. Just don’t invest. It’s that simple.

Cherbey Gift

November 29, 2025 AT 04:11Let me tell you something about the Nigerian crypto scene-we don’t have tools like RPHunter. We have WhatsApp groups, uncle’s cousin’s friend who ‘knows a guy’. We’ve been rug-pulled so many times we now laugh about it. But here’s the twist: we also built our own community watchdogs. We call them ‘OGs’. They don’t have algorithms. They have scars. And they know a scam when they smell one. Sometimes, the oldest wisdom is the most accurate.

Hannah Kleyn

November 29, 2025 AT 12:35I’ve been reading this whole post and I’m just… curious. Like, if all these tools are so good, why are rug pulls still happening every week? Is it because scammers are smarter? Or because we’re just too lazy to read the contract? Or maybe… we don’t want to know? I feel like the real question isn’t ‘how do we detect scams’ but ‘why do we keep giving them money?’

gary buena

November 30, 2025 AT 07:40lol i just checked my last investment on token sniffer. 12/100. i thought it was a ‘community project’. turns out the dev’s wallet owns 78% of supply. i’m deleting the app. not because i’m mad. because i’m embarrassed.

Kevin Hayes

December 1, 2025 AT 16:38The philosophical underpinning of this entire discourse rests upon the assumption that transparency is a virtue. But in decentralized systems, anonymity is not a flaw-it is a feature. The moment we demand identity, we move from crypto to surveillance. We must ask: are we protecting investors… or controlling them?

Katherine Wagner

December 3, 2025 AT 05:01Tools… tools… tools… why not just… don’t invest…? I mean… really…? Why do we need… AI… to stop… us… from… being… stupid…?

Drew Monrad

December 4, 2025 AT 10:02Everyone’s acting like this is new. Newsflash: every ‘revolutionary’ tool is just a rebrand of the same 3 checks from 2017. The only thing that’s changed? The price of the tokens you’re getting ripped off on. Now it’s $5000 instead of $50. Progress.

Byron Kelleher

December 4, 2025 AT 14:56hey everyone i just wanna say thank you for this thread. i was about to put $1000 into a new token called ‘AI Cat Coin’ because the logo was cute. then i saw this. i didn’t invest. i made tea instead. best decision i’ve made all week. you guys are the real MVPs 🫶

Cody Leach

December 6, 2025 AT 12:35Just want to say Token Sniffer is free. GoPlus is free. Elliptic’s public dashboard is free. You don’t need to pay for anything. Stop giving money to projects that charge $50 for ‘premium scam detection’. That’s the rug pull.

Anthony Forsythe

December 6, 2025 AT 14:42Let us not forget the metaphysical horror of this entire ecosystem: we are willingly surrendering our financial sovereignty to anonymous entities who write code in the dead of night, funded by the collective delusion that ‘this time it’s different’. The smart contract is our new altar. The liquidity pool, our sacrificial offering. And the AI tools? They are not our saviors-they are the priests who bless the ritual while knowing full well the gods are dead. We are not victims of fraud. We are acolytes of a cult that worships the illusion of gain. And the most terrifying part? We still show up every day.

Albert Melkonian

December 7, 2025 AT 11:20Thank you for this. I’ve been using these tools for a year now. I still lose money sometimes-but now it’s because I made a bad call, not because I was blind. That’s the difference between risk and stupidity. Keep learning. Keep checking. Keep walking away.