Central Bank of Jordan Crypto Policy: What You Need to Know in 2026

Before September 2025, owning or trading cryptocurrency in Jordan was a legal gray area. The Central Bank of Jordan had banned banks from handling Bitcoin since 2014. People still traded - mostly through peer-to-peer apps and informal networks - but there was no protection, no rules, and no way to report fraud. That changed with Law No. 14 of 2025, the Virtual Assets Transactions Regulation Law. It didn’t just lift the ban. It completely rewrote the rules.

From Ban to License: How Jordan Changed Its Mind

The Central Bank of Jordan didn’t wake up one day and decide crypto was a good idea. The shift came after pressure from the Financial Action Task Force (FATF). In 2023, Jordan was put on the FATF grey list because regulators couldn’t track crypto flows. Money laundering risks were high, and international partners started to take notice. The government had two choices: fix it or risk being cut off from global finance.

They chose to fix it. Law No. 14 of 2025 didn’t just allow crypto - it created a licensing system that forces every company dealing with virtual assets to register, verify users, monitor transactions, and report anything suspicious. The Jordan Securities Commission (JSC) now runs the show, not the Central Bank. That’s important. It means crypto isn’t treated like money. It’s treated like a security - something you need a license to trade or manage.

What’s Actually Illegal Now

If you’re running a crypto exchange, wallet service, or even a DeFi platform in Jordan without a JSC license, you’re breaking the law. It doesn’t matter if you’re based in Amman or just targeting Jordanian customers from abroad. The law says any service that operates within Jordan’s territory - physically or digitally - must be licensed.

That includes:

- Exchanging crypto for Jordanian Dinars

- Hosting a crypto wallet for Jordanian residents

- Running an app that lets Jordanians buy or sell Bitcoin

- Marketing crypto services to people living in Jordan

Violations aren’t handled with a warning. The law says you could face at least one year in prison and fines up to $141,000 (100,000 Jordanian Dinars). There’s no gray zone. If you’re not licensed, you’re breaking the law - even if you think you’re just helping friends trade.

How to Get Licensed (And Why It’s Hard)

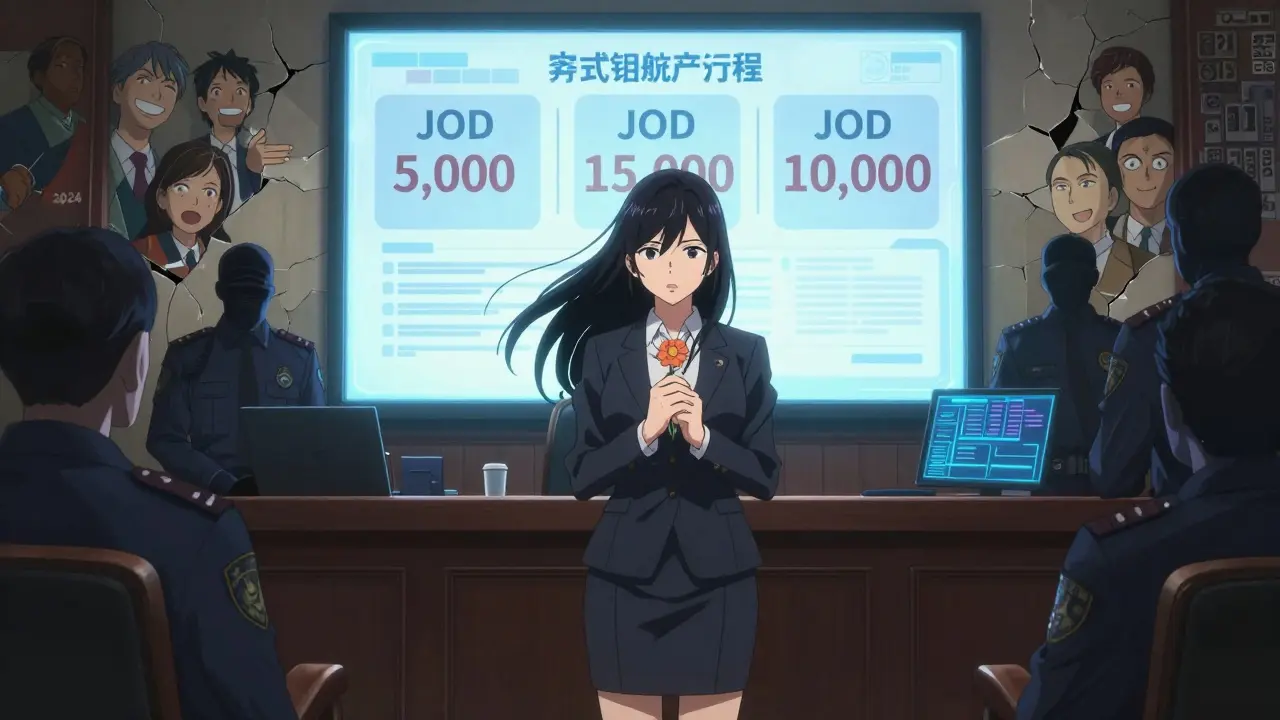

Getting a license isn’t cheap or fast. The JSC has laid out a three-step process:

- Preliminary application: Pay JOD 5,000 (about $7,000)

- Submit full compliance docs: Pay JOD 15,000 (about $21,000)

- Operational review: Pay JOD 10,000 (about $14,000)

Total upfront cost? JOD 30,000 - over $42,000. And that’s just to apply. You still need to prove you have:

- A dedicated AML compliance officer

- Transaction monitoring software that flags suspicious activity

- Customer identity verification systems (KYC)

- Five years of record-keeping

- Compliance with the Travel Rule (sharing sender/receiver info on transfers over JOD 10,000)

Many startups can’t afford this. Even established fintechs in Jordan admit the costs are daunting. A survey by the Jordan Fintech Association found that 73% of small companies struggled to integrate the required monitoring tools. And there’s a skills gap - only 60% of firms could find staff trained in crypto compliance.

Who’s Already Licensed? And Who’s Not

As of February 2026, fewer than 12 companies have received full licenses. Most are large financial technology firms with ties to regional banks. No peer-to-peer app, no local crypto exchange, no DeFi platform has made it through yet.

That’s because the law doesn’t just require money - it requires infrastructure. You need to prove you can handle real-time monitoring of blockchain transactions, detect PEPs (politically exposed persons), and report to the Anti-Money Laundering Unit (AMLU) within 24 hours. That’s not something a side-hustle team can build in a weekend.

Meanwhile, informal trading is still alive. Around 85% of Jordan’s 1.2 million crypto users still trade via Telegram groups or international exchanges like Binance. They’re not breaking the law - yet. But if they start using a local service that’s not licensed, they could be pulled into investigations.

How Jordan Compares to Its Neighbors

Jordan isn’t the first in the region to regulate crypto. The UAE has over 500,000 daily traders and a federal system with clear rules. Bahrain has a sandbox environment for startups. But Jordan’s approach is stricter than both.

Compare that to Egypt, Kuwait, and Iraq - all still ban crypto entirely. Jordan chose a middle path: not as open as the UAE, not as closed as its neighbors. It’s trying to be the “responsible” hub - clean, compliant, and aligned with global standards.

But that also means it’s behind. The UAE has a $1.2 trillion annual crypto volume. Jordan’s market was worth $150 million in 2024. Experts predict it could hit $750 million by 2027 - but only if the licensing process becomes faster and cheaper.

The Hidden Costs: Compliance and Culture

Most people don’t realize how deep the compliance rabbit hole goes. The law requires every licensed firm to:

- Train staff on FATF guidelines

- Run background checks on employees

- Submit quarterly reports to the JSC

- Pass annual audits by approved third-party firms

For a small team of five people, this isn’t just paperwork - it’s a full-time job. One crypto entrepreneur in Amman told me: “I spent six months just filling out forms. I didn’t touch code once.”

There’s also a cultural shift. For years, Jordanians trusted peer-to-peer trades because they didn’t trust banks. Now, the government is asking them to trust regulators. That’s a hard sell. Social media sentiment analysis from September 2025 showed 62% of users felt relieved by the new rules - but 78% worried it would lock out small players.

What’s Coming Next

The government isn’t stopping here. By mid-2026, they plan to release rules for DeFi platforms - something no other country in the region has done yet. The Central Bank of Jordan is also working on a digital dinar - a central bank digital currency (CBDC) - and plans to test it in Q3 2026.

There’s talk of creating a “Sharia-compliant crypto” framework too. With 42 Islamic banks in Jordan, there’s room for a niche market. But no details have been released yet.

The biggest question hanging over all of this is: Can the Jordan Securities Commission handle it? Right now, only 12 staff members are assigned to virtual assets. The IMF warned this is not enough. If enforcement is weak, the whole system could collapse under its own weight.

What This Means for You

If you’re a Jordanian trader: You can still use international exchanges. Just don’t use any local service that isn’t licensed. If you’re thinking of starting a crypto business in Jordan - prepare for a long, expensive, and complex process. The rules are clear, but the path is narrow.

If you’re an investor: Jordan’s market is still too small to be a major player. But if the licensing system stabilizes, it could become a testing ground for compliant, regulated crypto in the Arab world.

The Central Bank of Jordan didn’t just change its policy. It changed the game. Whether it’s a smart move or a missed opportunity will depend on how well the regulators can keep up.

Is it legal to own Bitcoin in Jordan in 2026?

Yes, owning Bitcoin or any other cryptocurrency is legal in Jordan. The law doesn’t ban personal ownership. What’s illegal is operating a crypto service - like an exchange, wallet, or trading platform - without a license from the Jordan Securities Commission. Individuals can still buy, hold, and trade crypto on international platforms like Binance or Coinbase without breaking the law.

Can I start a crypto business in Jordan?

You can, but it’s not easy. You must apply for a license through the Jordan Securities Commission. The process costs at least JOD 30,000 ($42,250) in fees alone, and you must meet strict AML/CFT requirements, including hiring a compliance officer, installing transaction monitoring software, and passing audits. Most startups find the cost and complexity too high. Only 12 companies have been licensed as of February 2026.

What happens if I use an unlicensed crypto service in Jordan?

If you’re just using an unlicensed service to buy or trade crypto, you won’t be prosecuted. The law targets service providers - not users. However, if the service is shut down by authorities, you could lose access to your funds. There’s also a risk that unlicensed platforms are not secure, increasing the chance of fraud or hacking.

Why did Jordan change its crypto policy?

Jordan was placed on the Financial Action Task Force (FATF) grey list in 2023 because regulators couldn’t track crypto transactions. This put pressure on Jordan’s banking relationships with other countries. Law No. 14 of 2025 was created to meet international standards, reduce money laundering risks, and avoid being cut off from global finance. It was a survival move, not a tech trend.

Is the Central Bank of Jordan issuing its own digital currency?

Yes. The Central Bank of Jordan is developing a Central Bank Digital Currency (CBDC), called the digital dinar. A pilot program is scheduled to launch in Q3 2026. This is separate from the virtual assets law - the CBDC will be under the Central Bank’s control, while private crypto services are regulated by the Jordan Securities Commission.

Will Lum

February 11, 2026 AT 14:21Crystal McCoun

February 11, 2026 AT 19:54Keturah Hudson

February 12, 2026 AT 22:17Ekaterina Sergeevna

February 14, 2026 AT 04:59Santosh kumar

February 15, 2026 AT 06:35Christopher Wardle

February 17, 2026 AT 01:33Tammy Chew

February 17, 2026 AT 23:31monique mannino

February 19, 2026 AT 09:51Kaz Selbie

February 21, 2026 AT 08:02Brittany Meadows

February 23, 2026 AT 00:16Michelle Cochran

February 24, 2026 AT 15:50Robbi Hess

February 25, 2026 AT 20:22Ben Pintilie

February 27, 2026 AT 02:40Holly Perkins

February 27, 2026 AT 15:53Sanchita Nahar

March 1, 2026 AT 07:47Donna Patters

March 1, 2026 AT 20:01Ace Crystal

March 3, 2026 AT 11:23