Russian citizens face severe crypto exchange restrictions in 2025. Only the wealthy can legally trade. Most rely on risky P2P platforms and VPNs. Here's what works, what doesn't, and why the system is failing.

Crypto Sanctions Russia: What Happened and Who Got Hit

When Russia invaded Ukraine in 2022, Western governments didn’t just freeze bank accounts—they went after crypto sanctions Russia, targeted blockchain transactions to cut off funding routes and evade traditional financial controls. Also known as crypto financial restrictions, these moves were unprecedented: suddenly, crypto wasn’t just a speculative asset—it became a geopolitical tool. The U.S., EU, UK, and Australia moved fast. They blacklisted Russian crypto exchanges, blocked wallet addresses tied to sanctioned individuals, and pressured platforms like Binance and Kraken to freeze accounts. This wasn’t about stopping Bitcoin. It was about stopping the flow of money that couldn’t be tracked through SWIFT.

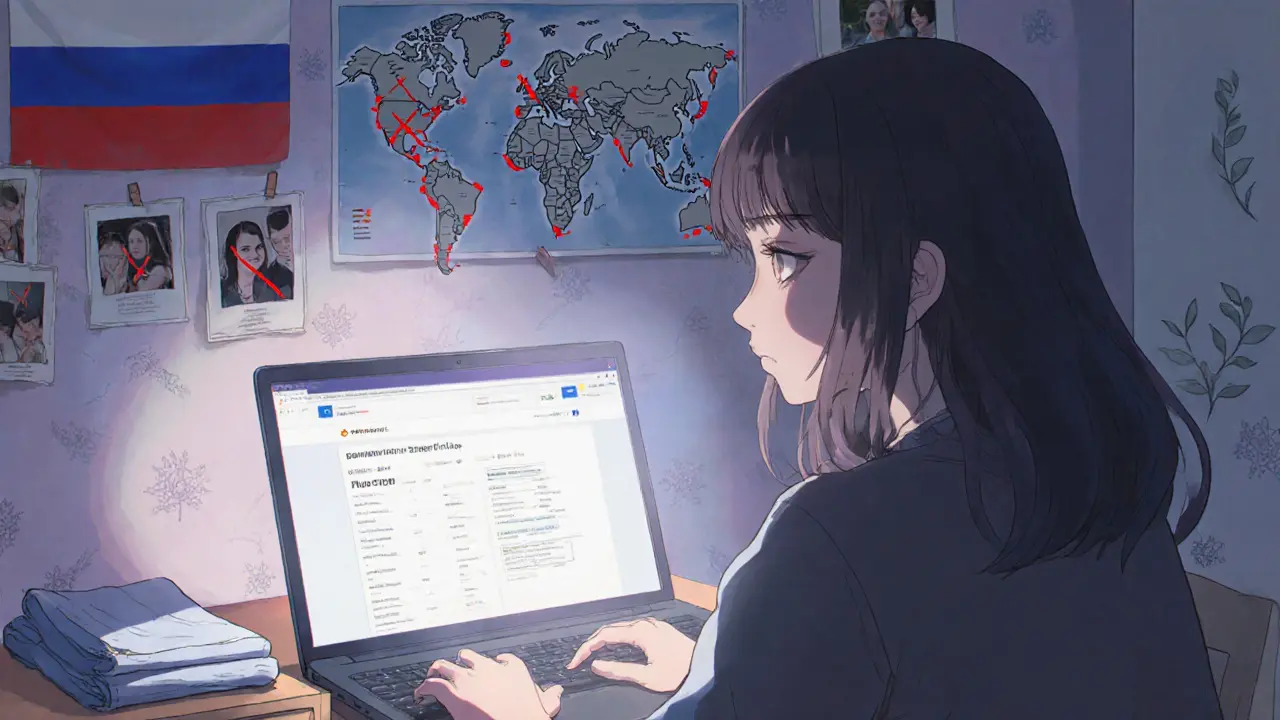

What followed was a messy, real-time experiment in blockchain sanctions, the use of public ledgers to enforce state-level financial penalties. Also known as on-chain enforcement, it exposed how decentralized systems can still be pressured by centralized power. Wallets linked to Russian oligarchs or state-backed entities were flagged. Exchanges were forced to comply—or lose access to global banking rails. Meanwhile, Russians turned to peer-to-peer platforms, decentralized exchanges, and privacy coins like Monero. But even those weren’t safe: tools like Chainalysis and Elliptic helped track suspicious flows, and some P2P traders got scammed or arrested. The Russian crypto crackdown, the government’s own response to Western sanctions. Also known as crypto capital controls, it included banning foreign exchanges, pushing citizens toward state-approved digital rubles, and cracking down on mining operations that used imported hardware. It created a two-tier system: those with access to offshore wallets could still trade, while most ordinary Russians were locked out.

Today, the effects are still visible. Russian-linked addresses still appear in transaction data, but they’re smaller, more hidden, and often mixed with tumblers. The global crypto industry learned a hard lesson: compliance isn’t optional anymore. Even the most decentralized projects now have to consider geopolitical risk. And for users? If you’re in a country under sanctions—or if you trade with someone who is—you’re not just watching the market. You’re part of a financial war that’s being fought on public ledgers. Below, you’ll find real cases of crypto scams tied to this chaos, exchanges that got caught in the crossfire, and how people tried—and failed—to outsmart the system.