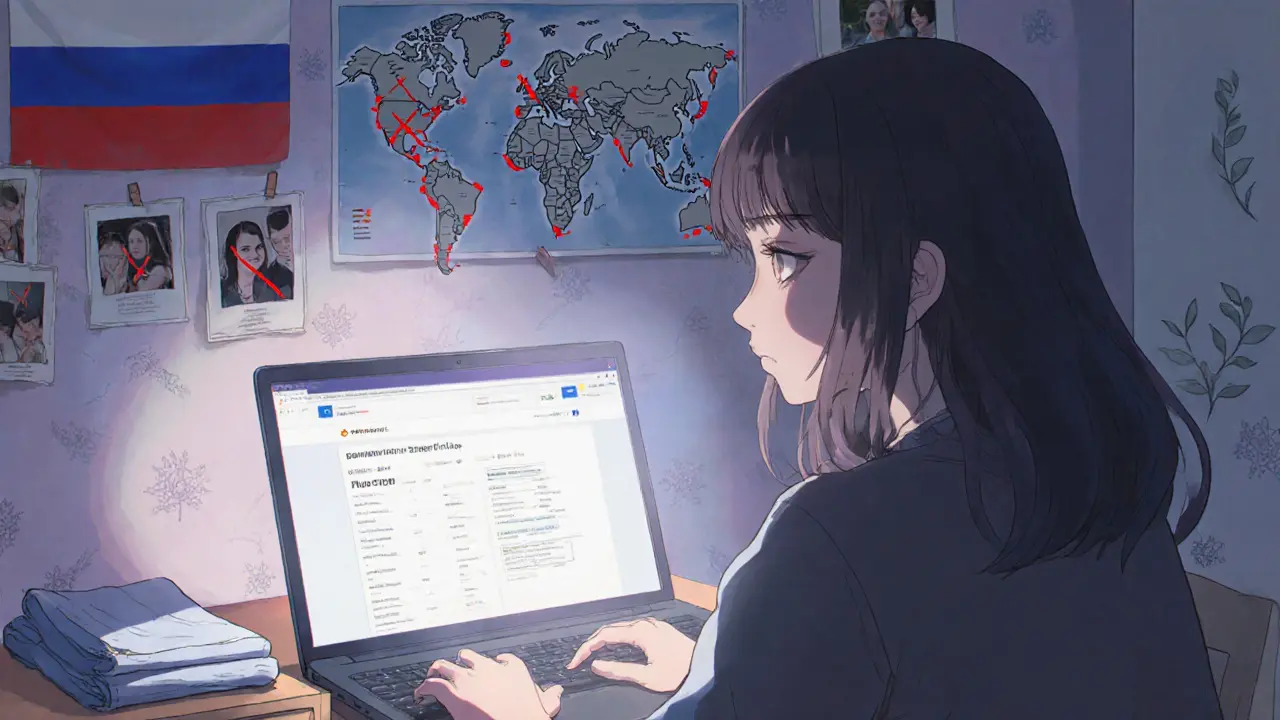

Russian citizens face severe crypto exchange restrictions in 2025. Only the wealthy can legally trade. Most rely on risky P2P platforms and VPNs. Here's what works, what doesn't, and why the system is failing.

Crypto Exchanges in Russia: What’s Allowed, What’s Banned, and Where to Trade

When it comes to crypto exchanges in Russia, platforms where users buy, sell, and trade digital assets under Russia’s legal framework. Also known as cryptocurrency trading platforms in Russia, they operate in one of the most restrictive environments in the world. Unlike countries that welcome crypto, Russia has spent years walking a tightrope—banning some activities while quietly allowing others. The government doesn’t outright ban owning Bitcoin or Ethereum, but it makes it extremely hard to use local banks, exchanges, or payment systems to touch them. If you’re trying to trade crypto in Russia, you’re not just fighting market volatility—you’re fighting a legal gray zone.

The Russian crypto regulations, a patchwork of laws, decrees, and enforcement actions that control how digital assets can be used within the country have changed dramatically since 2020. In 2021, the Central Bank pushed to ban all crypto payments. By 2023, they were calling crypto a threat to financial stability. But here’s the twist: in 2024, Russia quietly started allowing licensed exchanges to operate under strict oversight—only if they’re registered with the Central Bank and don’t serve retail users directly. That means most people aren’t using Binance or Kraken—they’re using peer-to-peer platforms, offshore exchanges with VPNs, or unregulated local services that don’t ask questions. The crypto trading Russia, the real-world activity of buying and selling digital assets by Russian citizens despite legal restrictions still happens, but it’s done in the shadows.

What about crypto wallet Russia, digital tools Russians use to store and manage their cryptocurrency holdings outside of regulated exchanges? Wallets themselves aren’t illegal. You can hold Bitcoin in a Ledger or a Trust Wallet without breaking the law. But if you try to convert it to rubles through a bank, or use it to pay for goods in a store, you’re asking for trouble. The government tracks transactions linked to known exchanges. If your wallet sends crypto to a flagged address, you might get a visit from tax authorities—or worse. And forget about using Russian exchanges like CEX.IO or Garantex anymore. Most have either shut down, moved offshore, or stopped serving Russian users entirely after Western sanctions hit.

So what’s left? A few decentralized platforms, Telegram-based P2P markets, and offshore exchanges that don’t verify your ID. But these aren’t safe. Withdrawals get stuck. Scammers pose as brokers. Fake apps steal private keys. And if you’re caught, you could face fines, asset seizures, or even criminal charges under new anti-crypto laws passed in 2024. The truth? There’s no legal, easy way to trade crypto in Russia today. The system is built to discourage it. That’s why so many Russians are moving their assets abroad, using foreign exchanges, or simply holding cash. If you’re still trying to trade locally, you’re taking serious risks.

Below, you’ll find real reviews and warnings about platforms Russians have tried—and lost money on. You’ll see which exchanges got shut down, which tokens turned out to be scams, and what alternatives actually work. No fluff. No promises. Just what’s happening on the ground.